Key Points:

- Sanders and Trump support converting tech subsidies into government equity.

- Intel gets $2B from SoftBank amid market concerns over federal ownership.

- Policy treats chips as strategic assets, aiming returns for taxpayers.

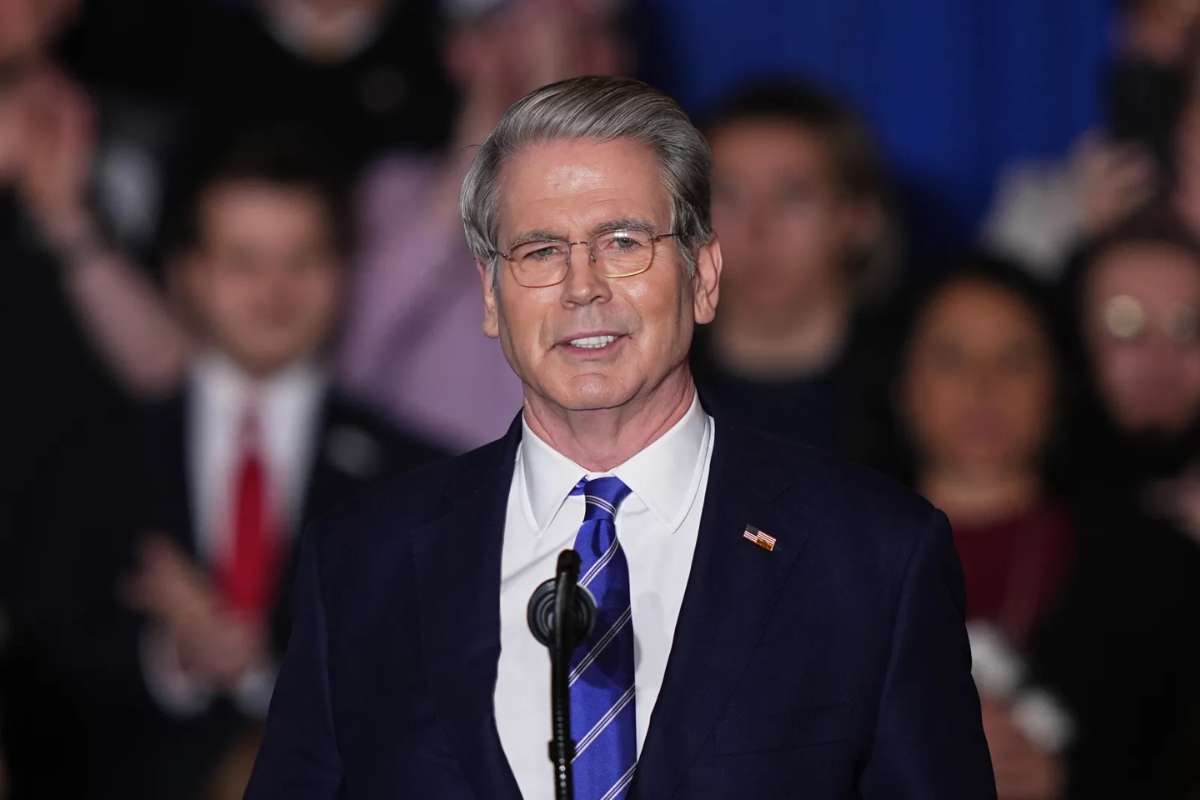

In a rare moment of bipartisan agreement, Senator Bernie Sanders has voiced his support for President Donald Trump’s plan to convert federal subsidies into government equity stakes in major technology companies, beginning with Intel. The move would mark a shift in how taxpayer-funded grants are structured under the CHIPS and Science Act, which allocated billions to strengthen domestic semiconductor production.

Bernie Sanders argued that if corporations benefit from public money, citizens deserve a share in the returns, especially when firms like Intel have received more than $10 billion in subsidies. The senator highlighted that the initiative closely mirrors a measure he proposed in 2022, which called for the government to secure warrants, equity, or senior debt in exchange for subsidies.

Commerce officials have clarified that any government equity would be non-voting, meaning it would provide financial participation without influence over Intel’s management or strategy. The central goal, they stressed, is to ensure taxpayers receive value in return for their contributions.

Government and Corporate Responses

Treasury Secretary Scott Bessent reinforced the administration’s intent, confirming that grant-to-equity conversions are being seriously considered as a way to stabilize Intel while preserving U.S. dominance in chip manufacturing. This policy may later extend to other semiconductor firms funded under the CHIPS program, reflecting a broader government push to tie subsidies directly to public benefit.

The debate coincided with a significant private sector development: SoftBank injected $2 billion into Intel, securing a near-2 percent stake at $23 per share. This lifeline underscored Intel’s urgent need for capital as it works to regain competitiveness in the global semiconductor race. Markets, however, responded uneasily to the news of potential government equity stakes. While Intel initially gained from the SoftBank investment, its shares later slumped sharply as investors weighed the implications of federal ownership.

Political and Market Implications

The alignment of Bernie Sanders and Trump on this issue underscores a growing willingness across party lines to embrace state involvement in strategic industries. Trump has previously pursued similar approaches, favoring revenue-sharing and minority ownership models in critical sectors. Analysts suggest that applying this framework to semiconductors signals a recognition of chips as national security assets, not just commercial goods.

Investor reaction has been mixed. Some see government equity as a safeguard for long-term stability and a guarantee of continued federal support for Intel. Others fear dilution, reduced flexibility, and added political entanglements. Intel’s volatile stock performance this week reflected those anxieties.

Despite the uncertainty, advocates argue that equity-based subsidies strike a balance between public accountability and private innovation. By structuring the government’s role as a passive financial participant, the approach promises to secure returns for taxpayers without undermining the autonomy of companies at the heart of America’s technology future.