France’s political crisis is now impacting its financial markets, as the country’s borrowing costs reached the same level as Greece’s for the first time on record. On Thursday, the spread between French and Greek 10-year government bond yields narrowed to zero, reflecting growing concerns about France’s political crisis and economic stability.

The yield on France’s 10-year bonds stood at 3.001%, while Greece’s equivalent was at 3.030%. This parity indicates that investors are now demanding nearly identical returns for holding French and Greek debt. Greece has long been seen as a riskier borrower due to its history of financial instability.

Political Uncertainty Driving Market Anxiety

The shift in bond yields underscores the growing unease over France’s political crisis. Prime Minister Michel Barnier’s government is struggling to secure support for the 2025 budget, which proposes 60 billion euros in tax increases and spending cuts to address France’s widening budget deficit.

The left-wing New Popular Front alliance has threatened to file a vote of no confidence if the government tries to push the budget through parliament. Compounding the issue, the far-right National Rally party has signaled its willingness to back the no-confidence motion, a move that could topple the government and lead to heightened political instability.

With no possibility of holding new elections until next June, political analysts predict prolonged uncertainty. The current minority government, formed by President Emmanuel Macron after parliamentary elections in 2023, faces increasing pressure to stabilize the situation.

Officials Defend Economic Stability

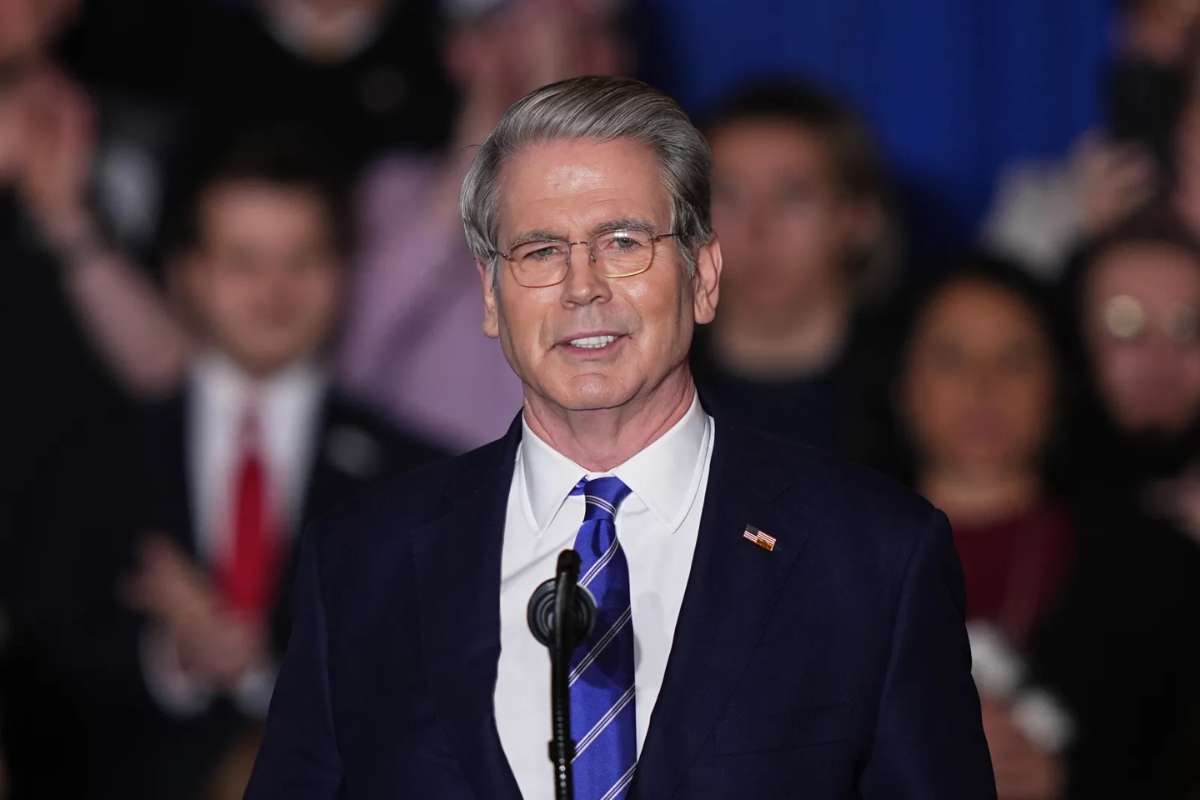

French officials are working to reassure investors, despite the troubling development in bond markets. Economy Minister Antoine Armand emphasized that France’s economy remains fundamentally strong and should not be compared to Greece.

Armand highlighted France’s robust economic activity, employment levels, and demographic advantages, asserting that the country’s situation is far from the debt crisis Greece faced in the aftermath of the 2008 global financial crash. He also commended Greece and other southern European countries for their efforts to implement savings and reforms.

Investor Concerns and Expert Analysis

Market experts warn that France’s political crisis could ripple across European financial markets. Jason Da Silva, director of global investment strategy at Arbuthnot, noted that political instability in a major European economy like France is bound to cause market fluctuations. However, he suggested that such disruptions might prompt lawmakers to adopt measures aimed at boosting growth.

Da Silva argued that market pressure could push political leaders to address the economic challenges facing France, particularly as the European Union faces additional headwinds like potential trade tariffs.

Meanwhile, Rabobank analysts cautioned that the political crisis could deepen if far-right leader Marine Le Pen supports the no-confidence vote. This could potentially lead to Barnier’s removal from office, escalating uncertainty in both political and economic spheres.

A Widening Deficit and Debt Burden

While France’s economic challenges are not as severe as Greece’s during its debt crisis, the nation is in urgent need of fiscal reforms. France’s budget deficit is projected to reach 6.1% of GDP in 2024, well above the EU’s 3% limit. Additionally, public debt surpassed 110% of GDP in 2023, far exceeding the EU guideline of 60%.

In contrast, Greece, which endured the eurozone’s worst debt crisis, has made significant progress in stabilizing its economy. The country is projected to achieve 2.1% GDP growth in 2024 and has been steadily reducing its debt-to-GDP ratio, which is expected to drop to 153.1% in 2024 and further decline in subsequent years.

Broader Implications

The current developments in France highlight the challenges faced by EU member states in maintaining fiscal discipline while addressing political pressures. France’s situation underscores the need for swift action to restore investor confidence and prevent further economic fallout.

As markets closely watch the unfolding political drama, the stakes remain high for France’s government to navigate these turbulent waters and avert further damage to its economic reputation.

Read More: Markets Navigate New Trump Policies as Tariff Announcements Shake Sectors