For over a decade, Trendrating has been empowering hundreds of global money managers to maximize performance and enhance risk control. Recognizing the increasing challenges faced by clients in the current market cycle, Trendrating provides superior data and solutions, delivering up-to-date market intelligence to capitalize on the wide performance dispersion among stocks. Trendrating understands that conventional data and traditional research often lag market movements. Therefore, they focus on advanced technology and cutting-edge solutions to stay ahead of the curve. This is their core mission.

The Active Management Gap

The underperformance of actively managed funds indicates that traditional methods are inadequate for consistent outperformance. Portfolio managers need new tools and insights, including sophisticated data analysis incorporating alternative data and advanced analytics, along with a deeper understanding of market dynamics, such as behavioral biases and the interplay of asset classes, to improve their chances of success.

The Challenge of Consistent Performance: Portfolio managers face the constant pressure to deliver superior returns.

Active Management Under Scrutiny: The data suggests that actively managed funds often struggle to justify their fees.

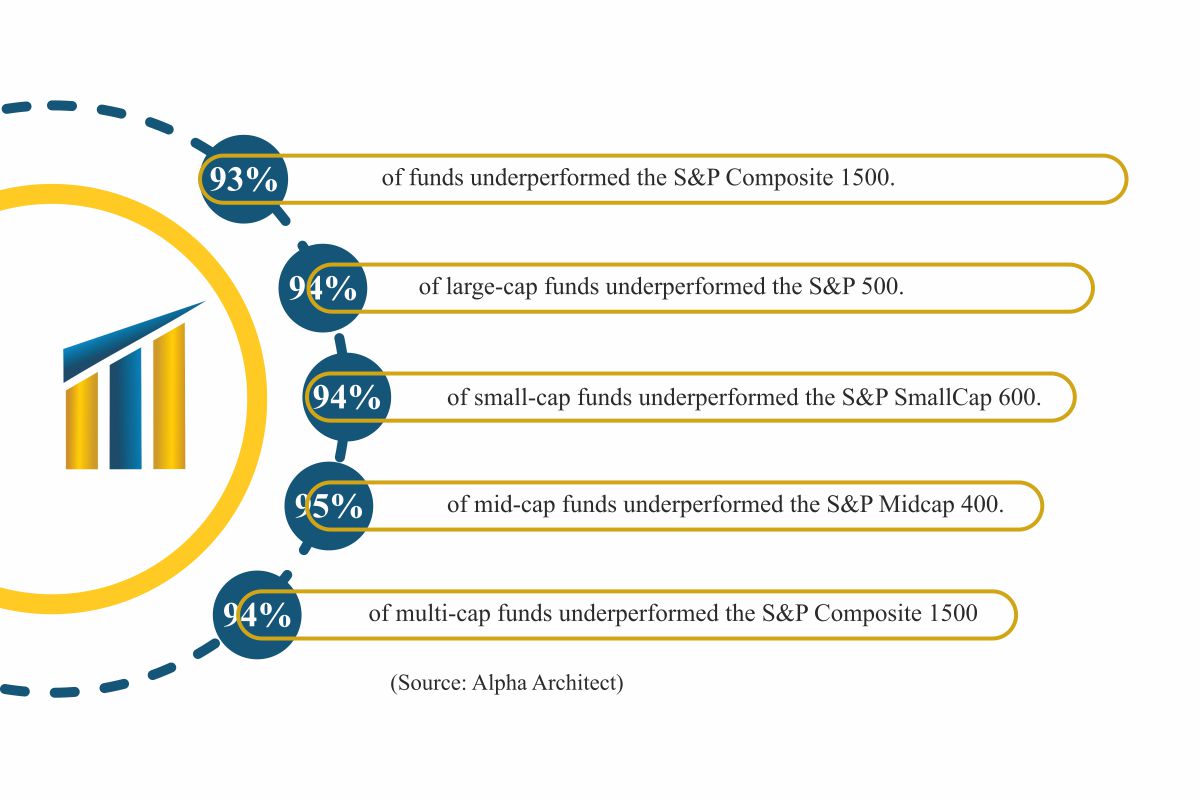

Widespread Underperformance: Over the last 20 years, the vast majority of actively managed funds have failed to beat their benchmarks:

- 93% of funds underperformed the S&P Composite 1500.

- 94% of large-cap funds underperformed the S&P 500.

- 94% of small-cap funds underperformed the S&P SmallCap 600.

- 95% of mid-cap funds underperformed the S&P Midcap 400.

- 94% of multi-cap funds underperformed the S&P Composite 1500 (Source: Alpha Architect)

Consistent Trend Across Styles: Similar underperformance rates were observed for both growth and value funds across different market capitalization categories.

The Need for Enhanced Intelligence: These findings highlight the critical need for portfolio managers to have access to better, more insightful market intelligence.

Failing to Deliver on Promise

The premise of active fund management rests on the idea that careful stock selection should lead to superior returns, exceeding benchmark performance. However, reality often diverges from this theoretical ideal. Actively managed funds frequently fail to meet expectations, consistently underperforming market indexes. (Source: SPIVA Scorecard)

Actively managed funds and ETFs are designed to capitalize on performance dispersion among stocks. This dispersion, where some stocks significantly outperform while others lag, theoretically allows active managers to exceed benchmarks by identifying winners and avoiding losers. For example, in the US large-cap universe over a recent six-month period, the top quartile of performers gained an average of 44%, while the bottom quartile lost an average of 17%, a substantial 61% differential.

Despite this opportunity, the question remains: how many active portfolio managers have successfully profited from it? This raises questions about the industry’s current approach. Why do actively managed products so often deliver only average returns, failing to exploit this performance dispersion? The issue may lie in the information and tools available to portfolio managers.

Conventional research, data, and systems, being widely used, demonstrably fail to provide a sufficient edge for exploiting this dispersion. The solution likely lies in advanced analytics and leading-edge technology, enabling the discovery of selection rules and parameters capable of capitalizing on performance dispersion. Enhanced information can lead to improved decision-making and, ultimately, better performance.

Beyond Conventional Wisdom

Trendrating aims to empower professional investors by addressing a critical gap in market intelligence. Its mission is to provide a unique platform designed to uncover the insights and intelligence necessary to generate measurable alpha. Trendrating’s approach begins with rigorous fact-finding, focusing on identifying the factors that best predict outperforming stocks. Their solution facilitates efficient discovery through systematic testing, optimization, and validation of the actual alpha contribution of individual parameters and their combinations.

Trendrating seeks to answer crucial questions, including: What selection criteria are consistently rewarded by the market across cycles? Which fundamental parameters offer the greatest potential for identifying outperforming stocks? And, what combinations of selection rules create a robust investment decision framework for optimized performance? Trendrating believes that answering these questions is essential for achieving superior investment outcomes, and that an objective, fact-based process is the only way to arrive at definitive answers. Their technology is designed to make this process both possible and accessible.

How does it work?

- Pick any selection rule from a rich database of parameters, covering fundamental, quantitative, volatility, size, and trend metrics. Decide the allocation and rebalancing rules.

- Test in any investment universe across 15 years of market cycles and assess the actual alpha contribution.

- Explore alternative combinations of rules that check more quality boxes.

- Optimize and discover the winning mix.

- Validate the results with rigorous evidence across the years.

- Design your winning strategy and execute it.

Tailoring Stock Selection for Market Success

Trendrating’s testing and assessment capabilities have yielded insightful findings. The ability to evaluate the effectiveness of various stock selection parameters over extended periods and across statistically significant samples provides valuable insights. Exploring different rule combinations and comparing their historical performance offers a robust, fact-based information framework, replacing conjecture with evidence.

Among the key findings are: First, different markets and sectors may favor distinct fundamental rules; a strategy effective in one sector may not be applicable to another. Second, exploring combinations of value and growth parameters can lead to improved returns, as incorporating more quality criteria strengthens the selection process. Finally, combining top-performing fundamental metrics with a trend filter (distinguishing positive from negative trends) can potentially deliver consistently superior returns by mitigating the risk of exposure to declining stocks.

A Vision for Superior Market Intelligence

Rocco Pellegrinelli’s career trajectory, from portfolio manager to the founder and CEO of Trendrating, is a testament to his vision and drive. He launched Brainpower in 1996, establishing it as a leading global portfolio management system. Following Brainpower’s successful IPO on the Frankfurt Stock Exchange in 2000, the company was acquired by Bloomberg in 2006. Subsequently, Mr. Pellegrinelli embarked on an intensive research and development project to create a more effective model for identifying price trends in listed equities.

After years of extensive testing, involving 350 indicators and thousands of combinations across 25 years of historical data for 20,000 securities, he achieved his goal. This achievement was facilitated by a dedicated team of experts, who now form part of Trendrating, a prominent provider of advanced analytics and cutting-edge technology for equity investing, serving over 300 institutional clients worldwide. Mr. Pellegrinelli’s leadership has garnered industry recognition. In 2020, he was named one of the “10 Most Inspiring CEOs to Watch” by Industry Tech Outlook and one of the “10 Best Innovative Leaders” by DigiTech Insight. He also contributes to the Nasdaq advisor portal.

Ahead of the Curve

Trendrating offers a novel and disruptive technology, enabling the discovery and validation of market insights and data that can demonstrably maximize performance and are unavailable through other systems. This commitment to innovation has been recognized by industry leaders. In 2021, Trendrating was awarded “Best Data Analytics Company of the Year” by CIO Bulletin. In 2022, the same platform recognized them as a “Best Strategy Management Solution Provider.” In 2023, Enterprise World Magazine featured Trendrating on its cover as a “Most Trusted Advanced Market Analytics Solution Provider Platform” and a “Top Performance Management Platform to Watch.” This year, CEO Views Magazine named Trendrating one of the “Most Innovative Companies to Watch.”

Unique Market Intelligence

Trendrating’s platform caters to both discretionary and systematic investors. Discretionary investors can leverage the platform to enhance their understanding of market dynamics and utilize the resulting insights to optimize investment strategies and model portfolios. Systematic investors can readily build, document, and execute custom, rule-based strategies. All investors can benefit from the unique market intelligence and well-documented insights provided by Trendrating, which are not accessible through other systems or services. Critically, the alpha contribution derived from using the Trendrating platform is fully transparent and measurable. This transparency forms the cornerstone of their value proposition, distinguishing their solution from conventional offerings.