In the world of online payments, things often look deceptively simple. Customers add an item to their cart, enter their card details, and hit “pay.” Within seconds, the money appears to move. But under the hood, a lot happens, and if you’re a business owner, freelancer, developer, or even just someone curious about how money flows on the internet, understanding the difference between a payment gateway vs. a payment processor can make all the difference.

Unfortunately, most people bundle these two into one mental category. Even some payment platforms market them as interchangeable. But the truth is, they play very different roles. One makes the transaction possible by securely handling customer data; the other handles the actual movement of money through banking systems. Both are essential, but they’re not the same.

Let’s understand what each is, how they work together, and why knowing the difference isn’t just technical knowledge; it’s business intelligence.

What Is a Payment Gateway?

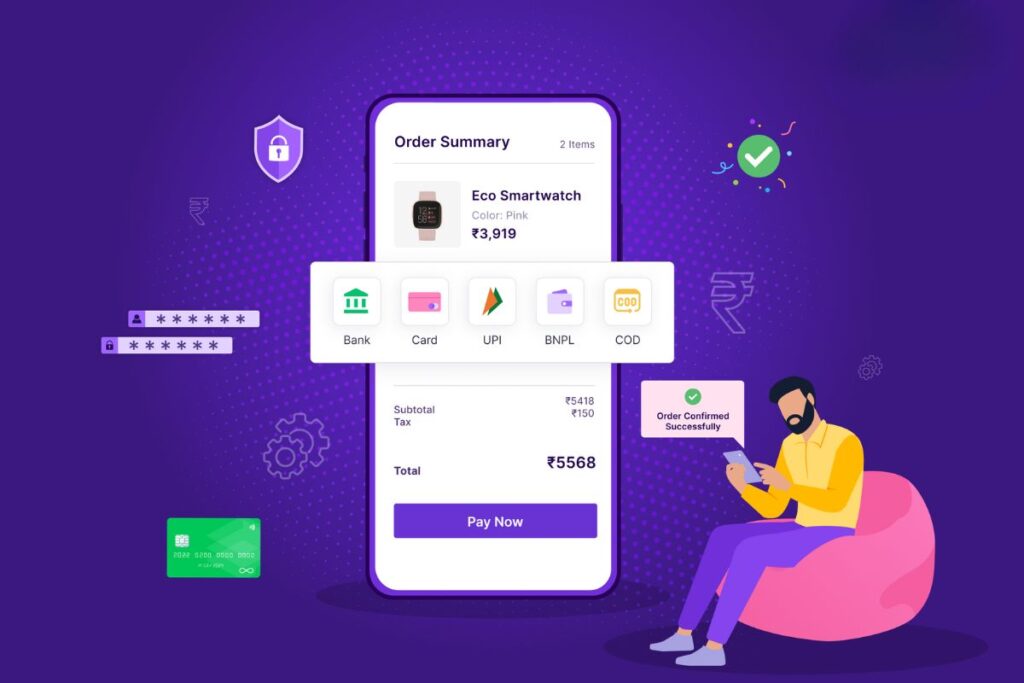

A payment gateway is the digital bridge between your online store and the bank. The interface collects payment details from your customer, whether that’s a credit card number, digital wallet credentials, or even BNPL options. Think of it like a digital cashier: it takes the payment details, encrypts the data, and sends it out for approval.

But the payment gateway isn’t just a passive collector. It’s built for security and fraud detection. When someone inputs their card number, the gateway checks that the number is valid, that the billing address matches, and that the transaction doesn’t raise red flags (like a mismatch in location or velocity of purchases).

If you’ve ever paid online and been redirected to a 3D Secure prompt (like “Verified by Visa”), that’s the payment gateway adding a layer of authentication. Gateways also provide a consistent user experience, something that’s more important than most businesses realize. A slow or clunky gateway can cause cart abandonment, especially if trust is low or the design looks suspicious.

This is the front-facing element in the discussion of payment gateway vs. a payment processor. Customers never “see” the processor, but they interact with the gateway every time.

What Is a Payment Processor?

The payment processor is the system that takes the encrypted payment data (collected by the gateway) and gets the banks involved. It acts as the transaction handler, speaking to credit card networks like Visa or Mastercard, requesting authorization from the cardholder’s bank (the issuing bank), and communicating the results.

Suppose a customer buys something on your Shopify store using a Mastercard issued by their local bank. The gateway encrypts their info and sends it to the processor. The processor asks Mastercard’s network, “Is there enough money in this account? Is this transaction authorized?” Mastercard forwards this to the customer’s bank, gets a yes or no, and returns the result.

If approved, the processor tells the gateway, and the customer sees “Payment Successful.” Then, over the next day or two, the processor ensures the funds move from the customer’s bank to your merchant account (usually through an acquiring bank).

This entire back-end relay is the processor’s job. It’s invisible but vital. Without it, encrypted data would go nowhere.

Payment Gateway vs. a Payment Processor: Key Differences

| Feature | Payment Gateway | Payment Processor |

| Function | Collects and encrypts customer payment details | Handles authorization and movement of funds |

| Role in Transaction | Acts as the front-end interface (checkout page) | Works behind the scenes to transfer funds |

| User Interaction | Directly interacts with customers during checkout | No direct interaction with the user |

| Credit Card Handling | Handles card data entry and initiates tokenization/encryption (e.g., card number, CVV) | Routes tokenized data to card networks and issuing banks for approval and settlement, including holds and settlement processing |

| Security | Encrypts payment data before transmission | Complies with networks and bank security protocols |

| Example Tools | Stripe Checkout, PayPal Gateway | First Data, Fiserv, Chase Paymentech |

Why It Matters to Understand the Difference

You might be wondering, Why should I even care? Isn’t this all just a bunch of technical language?

If you’re a small business owner, startup founder, or someone building an app that accepts payments, this distinction could save you money and headaches. Many all-in-one payment services (like Stripe, Square, or PayPal) bundle both gateway and processor into a single platform. That’s great for simplicity, but it can also limit your flexibility.

Understanding the divide helps you:

- Negotiate better transaction fees

- Understand where failures occur (gateway or processing issues)

- Choose specialized services (e.g., using a fraud-focused gateway with a high-speed processor)

- Stay compliant with PCI DSS and regional data regulations

- Scale globally (some processors don’t support certain currencies or regions)

How They Work Together

Here’s a typical transaction, explained in sequence:

- The customer enters payment details via your site or app.

- Payment gateway collects and encrypts that data.

- The processor receives the encrypted data and sends it to the card network (Visa, AmEx, etc.).

- The card network sends a request to the issuing bank (the customer’s bank).

- The issuing bank approves or declines the request.

- The processor gets the response and sends it back to the gateway.

- Gateway tells your site: “Transaction approved” or “declined.”

- If approved, funds are settled and transferred from the customer’s bank to your merchant account over 1–2 business days.

This relay system works in seconds. But behind the scenes, it’s a complex orchestration between parties. Understanding payment gateway vs. a payment processor helps demystify that flow.

Examples

Let’s say you’re selling digital art through a Shopify store. You install Shopify Payments, which uses Stripe under the hood. In this case, Stripe acts as both gateway and processor. It collects payment info, encrypts it, negotiates authorization, and handles settlement. Because Stripe handles both, you don’t think about the handoff between the gateway and the processor.

But imagine you run a SaaS company that wants to use a custom payment form. You might use Authorize.Net as your gateway and pair it with FIS Global or WorldPay as your processor. This gives you more control, but also requires knowing how each piece works.

In regulated markets (like India, Europe, or the UAE), having separate providers may help with compliance or localization. That’s when understanding payment gateway vs. a payment processor becomes strategic.

Fees and Costs

Here’s where things get real. Both gateways and processors charge fees, but they do it differently.

Gateways might charge:

- A monthly fee (e.g., $25/month)

- Per-transaction fees (e.g., $0.10 per transaction)

- Additional charges for fraud tools, tokenization, or recurring billing features

- Setup or integration fees for connecting to e-commerce platforms and POS systems

Processors usually charge:

- A percentage + fixed fee (e.g., 2.9% + $0.30)

- Higher fees for international or AMEX transactions

- Chargeback handling fees

- Batch settlement fees

How Payment Gateways Secure Every Checkout Without Slowing Sales

Here are the roles of payment gateway: 1. Customer initiates payment 2. Data encryption 3. Authorization request 4. Approval or decline

If your provider is handling both functions, fees are bundled. But with separate providers, you’ll pay both, so knowing what you’re paying for is key.

And this is yet another reason to clarify payment gateway vs. a payment processor, so you can audit your costs properly and avoid overpaying for services you don’t need.

Which One Should You Choose First?

If you’re starting from scratch, your initial focus should be on the gateway because it defines the checkout experience, fraud controls, and user trust. Once that’s in place, evaluate the processor based on speed, fees, and coverage.

But the processor becomes more critical if you’re scaling or moving into new markets. A poor processor can delay settlements, drop transactions, or cause currency conversion errors.

Ultimately, most modern platforms (like Stripe, Braintree, Adyen) combine both, but even then, they manage each part separately behind the curtain. So when you choose a provider, ask detailed questions about both functions.

Conclusion

Comparing a payment gateway vs. a payment processor is not just a technical debate; it’s the foundation of your entire online revenue system. One handles security and user trust; the other handles negotiation and money movement. Without one, the other fails.

When you know how these systems work, you become empowered. You can customize your checkout, reduce payment friction, spot errors faster, and even negotiate better terms with your provider.

Your customers may never think twice about what’s happening after they click “Pay.” But behind the scenes, there’s a beautifully orchestrated system that, when done right, can be the quiet engine of your success.