Shares of Walmart sales soared to record highs on Tuesday after the retail giant reported strong quarterly earnings, beat revenue expectations, and raised its full-year guidance. The company attributed its success to resilient U.S. customers, robust e-commerce growth, and rising in-store volumes, signaling a recovery in consumer spending on discretionary items.

Strong U.S. Performance

Walmart’s U.S. division experienced a 5% increase in sales, reaching $114.9 billion, surpassing analysts’ expectations of $113.61 billion. General merchandise sales turned positive for the first time in 11 quarters, reflecting a shift in consumer behavior as discretionary spending began to recover. Market share gains were primarily driven by upper-income households.

Chief Financial Officer John David Rainey highlighted that U.S. customers have remained resilient, with consumer behavior remaining consistent over the last four to six quarters. In-store shopping volumes grew steadily, while pickup and delivery services expanded at even faster rates, showcasing the company’s adaptability in meeting customer preferences.

Earnings and Revenue Highlights

For the quarter ending October 31, Walmart sales reported a net income of $4.58 billion, or 57 cents per share, a sharp rise from $453 million, or 6 cents per share, in the same period last year. Adjusted earnings per share reached 58 cents, beating analysts’ estimates of 53 cents.

Total revenue climbed 5.5% to $169.59 billion, exceeding expectations of $167.69 billion. This growth was fueled by a 27% surge in e-commerce sales and a 16.1% rise in membership and other income. Walmart sales has now surpassed revenue forecasts for 19 consecutive quarters.

Comparable-store sales in the U.S. rose 5.3%, exceeding projections of 3.8%. This growth was driven by a 3.1% increase in the number of transactions and a 2.1% rise in the average ticket value.

Growth in Sam’s Club and International Markets

Walmart’s membership-based warehouse division, Sam’s Club, also posted strong results. Net sales for Sam’s Club rose 3.9% to $22.9 billion, while comparable-store sales jumped 7%, marking the biggest beat in two years. Transactions increased by 6.4%, while the average ticket value rose by 0.5%.

International sales grew by 8% to $30.3 billion, exceeding expectations of $30.1 billion. This growth was fueled by strong performances in markets like Flipkart in India, Walmex in Mexico, and China.

Outlook for the Holiday Season

Following the strong quarterly performance, Walmart sales raised its full-year 2024 guidance. The company now expects adjusted earnings per share to range between $2.42 and $2.47, up from the previous forecast of $2.35 to $2.43. Projected net sales growth was also raised to 4.8% to 5.1%, compared to the earlier estimate of 3.75% to 4.75%.

Analysts have expressed optimism about Walmart’s momentum heading into the holiday season. Robust traffic trends at Walmart U.S. and Sam’s Club are expected to continue, supported by the company’s strong value proposition and strategic improvements to its business model.

Stock Performance

Walmart sales climbed 2.6% in early trading on Tuesday, pushing the stock into record territory. The stock has gained 60% year-to-date through Monday, significantly outperforming the Consumer Staples Select Sector SPDR ETF, which has risen 11.8%, and the Dow Jones Industrial Average, which has advanced 23.6%.

Analysts believe Walmart’s strong position and adaptability will help it maintain its growth trajectory. As the company continues to benefit from shifting consumer behavior and its investments in technology and services, it is well-positioned to thrive during the holiday season and beyond.

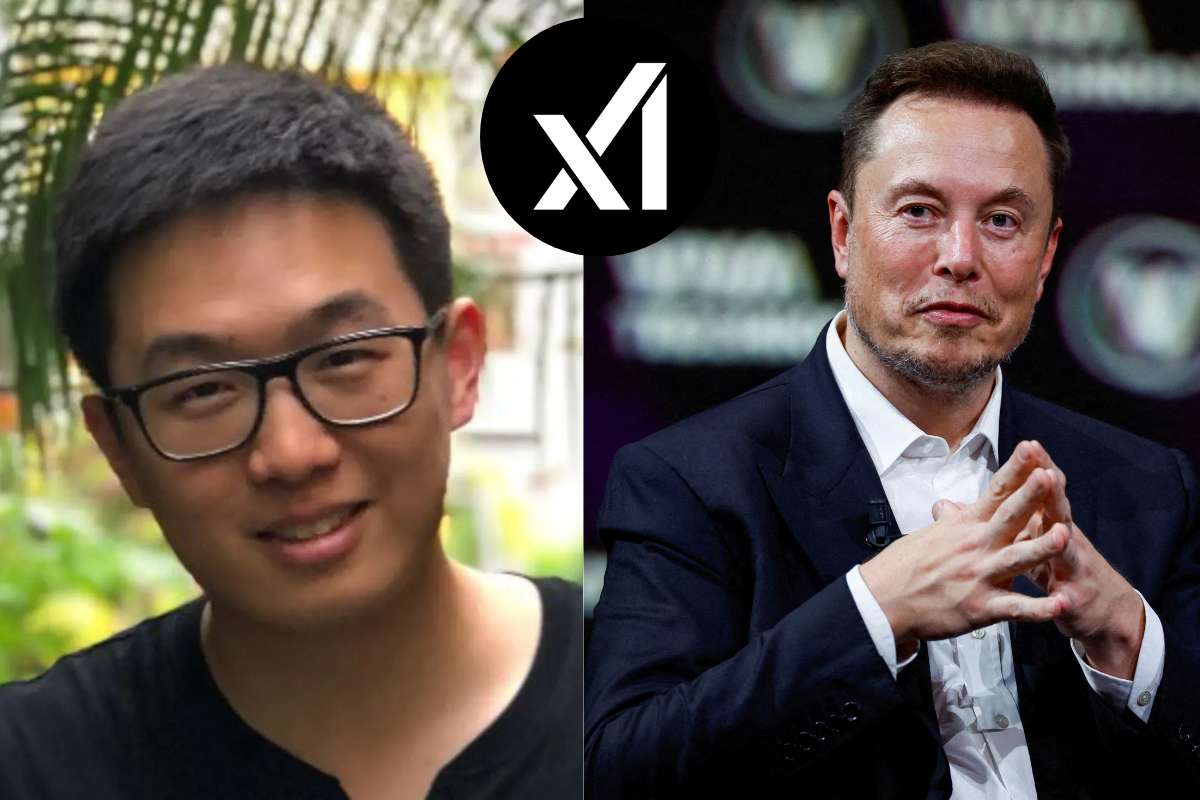

Read More: Tesla’s Stock Jumps 6%: Trump’s Influence on Musk’s Future