As living costs rise, job markets shift, and financial responsibilities evolve faster than ever, understanding your financial goals by age has become essential, not optional.

Your 20s are about building a strong financial foundation. It typically includes learning to budget, building savings, starting emergency funds, and making your first investments to set long-term habits.

Your 30s introduce larger responsibilities such as homeownership, family planning, and consistent long-term saving. This phase requires more structured financial planning and disciplined investing.

Your 40s and 50s focus on accelerating retirement contributions, reducing high-interest debt, and protecting assets. It’s a crucial period for strengthening financial stability and preparing for future income needs.

The goal in the 60s shifts to securing a steady and stress-free income stream for retirement. It involves optimizing savings, managing withdrawals wisely, and ensuring long-term financial comfort.

This decade-by-decade guide breaks down what to focus on, why it matters, and how small decisions made at the right time can significantly strengthen your long-term financial health. With clear milestones, practical steps, and expert-backed insights, you’ll understand exactly how to align your money choices with your stage of life and build a financial future that feels stable, confident, and fully in your control.

Financial Goals by Age: Consolidated Table

This consolidated table offers a decade-by-decade view of essential financial goals by age, making it easier to understand how priorities evolve as life progresses. Each stage builds on the one before it, starting with healthy money habits in your 20s, increasing financial protection in your 30s and 40s, maximizing savings in your 50s, and solidifying long-term security in your 60s. By following these age-based milestones, you create a structured, clear path toward financial freedom and a stable retirement.

| Age Range | Key Financial Goals | Why It Matters? |

| 20s | Build budgeting habits, start an emergency fund, begin investing, and pay off high-interest debt | Establishes a strong financial foundation and encourages early wealth-building |

| 30s | Expand emergency fund, diversify investments, save for major life goals, strengthen insurance, reduce long-term debt | Supports growing responsibilities and prepares for major financial milestones |

| 40s | Maximize retirement contributions, grow investments, fund children’s education, update insurance, pay down major loans, and plan for aging parents | Helps secure long-term stability while balancing family and future goals |

| 50s | Use catch-up retirement contributions, lower investment risk, eliminate remaining debts, upgrade insurance, plan retirement lifestyle, and update estate documents | Prepares you for retirement with focused savings and reduced financial pressure |

| 60s | Decide retirement age, finalize income strategy, enroll in senior healthcare, simplify finances, clear debts, and finalize legacy planning | Ensures a smooth transition into retirement with predictable income and clear planning |

| Retirement Prep | Calculate corpus, build income streams, strengthen healthcare, align investments, remain debt-free, and finalize will and nominees. | Creates a sustainable and secure retirement with aligned financial decisions |

Here is the Detailed Explanation of Financial Goals According to Age

1. Financial Goals in Your 20s

Your 20s are all about building the foundation that will shape your financial confidence for decades. This is usually the stage where you begin earning consistently, experience real expenses, and learn how money actually works outside textbooks. Setting clear financial goals by age here helps you avoid early mistakes and strengthens your long-term financial stability.

Key Priorities in Your 20s

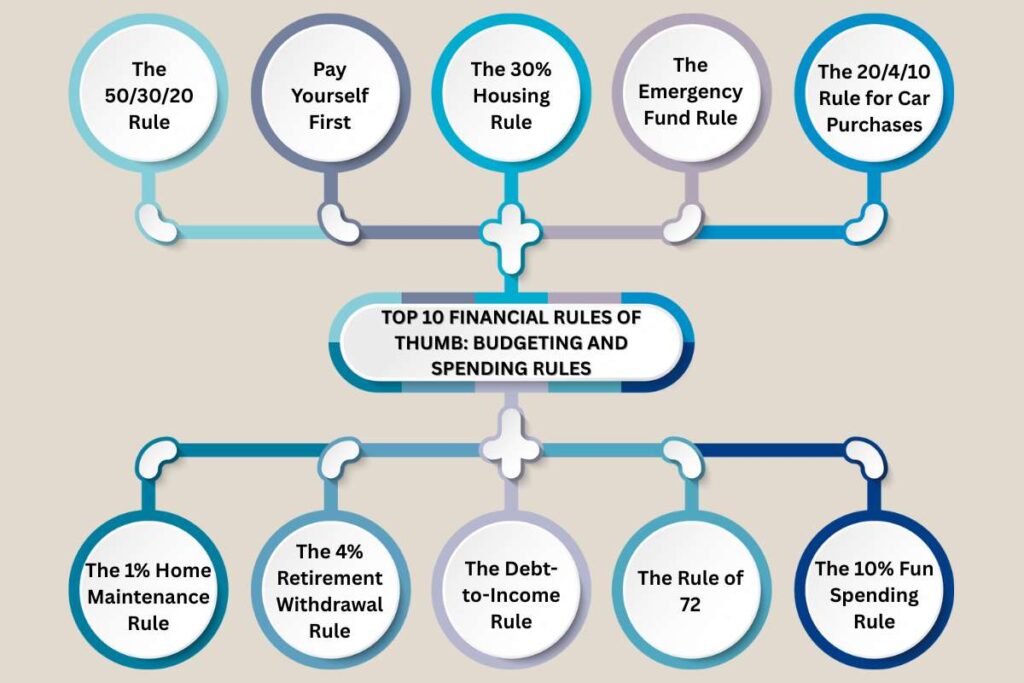

1. Build strong money habits.

- Create a simple budgeting system (50/30/20 is a good start)

- Track spending monthly to understand patterns.

- Set short-term and long-term savings targets.

2. Start an emergency fund.

- Aim for 3 months of essential expenses.

- Keep the money in a separate, easy-access savings account.

- Contribute consistently; even small amounts matter.

3. Begin investing early

- Take advantage of employer retirement plans and matches.

- Set up automated monthly investments or SIPs.

- Understand basic investment principles: compounding, risk levels, and diversification.

4. Manage and eliminate high-interest debt.

- Pay off credit card debt aggressively.

- Start clearing student loans or a personal loan. Maintain a healthy credit score to prepare for future milestones.

The table below highlights the key financial goals by age for individuals in their 20s, focusing on budgeting, early investing, and building an emergency fund. These early priorities establish the habits and financial discipline needed to support long-term growth and stability.

| Area | Goal | Why It Matters |

| Budgeting | Build a simple budgeting routine | Gives clarity and control over spending |

| Savings | Create a 3-month emergency fund | Protects you from unexpected financial shocks |

| Investing | Start retirement or long-term investments | Early compounding leads to significant growth |

| Debt | Pay down high-interest loans | Reduces financial stress and improves credit score |

2. Financial Goals in Your 30s

Your 30s are often a turning point financially. This decade usually brings more stability in income but also more responsibilities, buying a home, supporting family needs, career transitions, or planning for children. At this stage, your financial goals by age should focus on strengthening your foundation, reducing risks, and building long-term security.

While your 20s were about learning and experimenting, your 30s are about consistency and commitment. This is the time to expand your savings, optimize investments, and prepare for bigger future milestones. With rising costs and economic uncertainty, strategic planning in this decade can significantly influence your financial freedom later in life.

Key Priorities in Your 30s

1. Strengthen your emergency fund.

- Increase coverage to 3–6 months of expenses.

- Adjust the amount based on dependents and lifestyle.e

- Keep it in a highly liquid, safe investment or savings account.

2. Optimize your investments

- Increase SIP or retirement contributions as income grows.

- Consider diversifying into equity funds, index funds, bonds, or N.PS.

- Review your portfolio annually to rebalance risk.

3. Plan for major life expenses

- Start saving for a home down payment.

- Build a fund for children’s education (if relevant)

- Prepare for recurring large expenses like insurance premiums or home maintenance.e

4. Strengthen insurance and financial protection.on

- Get adequate life insurance (term plans preferred)

- Secure health insurance with sufficient coverage

- Consider disability insurance or income protection.

5. Tackle long-term and high-interest debt.

- Prioritize paying down credit cards, personal loans, and auto loans.

- Pay EMIs on time to maintain or improve your credit score. Re.

- Avoid taking unnecessary new debt unless absolutely required.

The table below outlines the most important financial goals by age for your 30s, a decade where responsibilities grow and financial planning becomes more structured. It shows how expanding your emergency fund, diversifying investments, and strengthening insurance contribute to long-term security.

| Area | Goal | Why It Matters? |

| Emergency Fund | Save 3–6 months of expenses | Provides a stronger safety net for family and career uncertainties |

| Investing | Increase contributions & diversify | Helps grow long-term wealth and reduces risk concentration |

| Life Planning | Save for home, education & major expenses | Prevents financial strain when big milestones arrive |

| Insurance | Strengthen coverage | Protects your family from unexpected financial burdens |

| Debt | Reduce long-term & high-interest loans | Frees up income and improves credit stability |

3. Financial Goals in Your 40s

Your 40s are often considered the peak of your earning years, but they also bring some of the biggest financial responsibilities. At this stage, your financial goals by age should focus on accelerating long-term wealth, protecting your family, and preparing for major future commitments like children’s education or aging parents. This is the decade where financial decisions carry more weight, both the smart choices and the overlooked ones.

By your 40s, most people have a clearer sense of their lifestyle, career stability, and long-term goals. This is the time to strengthen retirement planning, reduce liabilities, and ensure that your investments are working efficiently. You’re not just building wealth anymore, you’re shaping the future you want to live in.

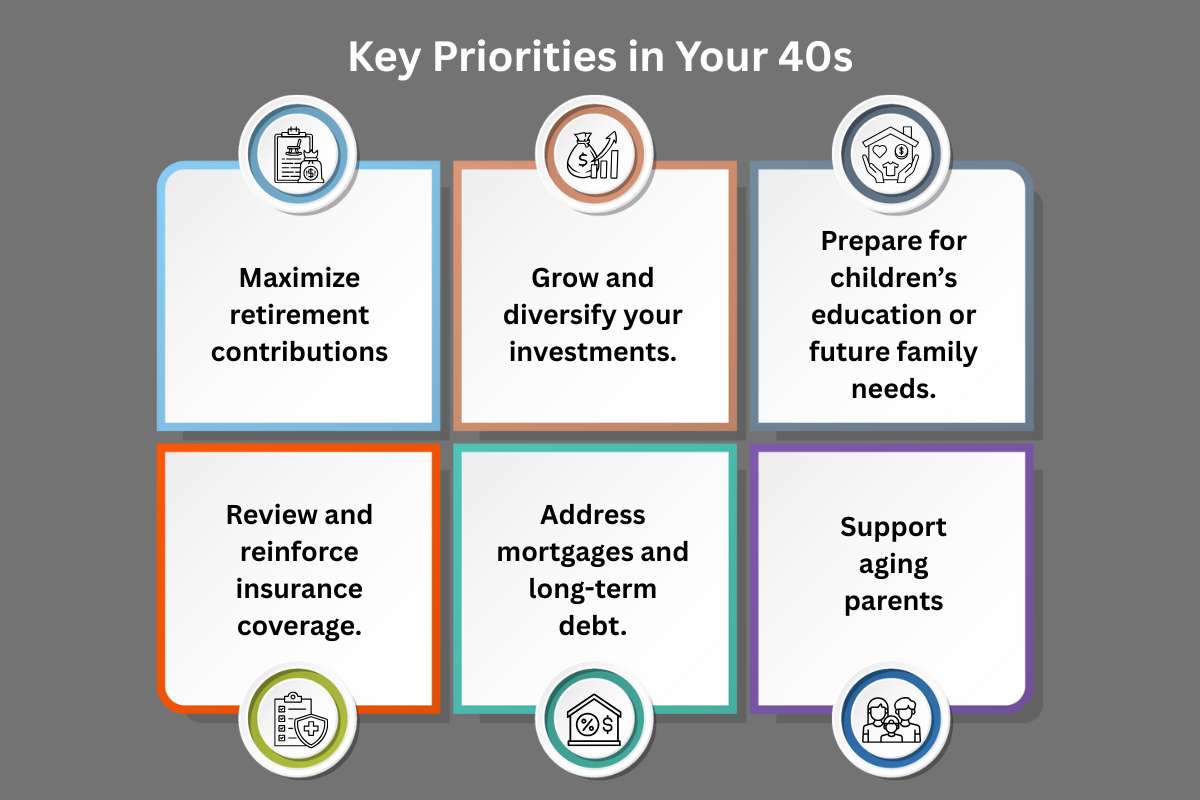

Key Priorities in Your 40s

1. Maximize retirement contributions

- Increase contributions to retirement accounts and long-term investments.

- Take advantage of employer benefits and investment-linked tax advantages.

- Ensure your retirement corpus is growing in line with future cost-of-living expectations.

2. Grow and diversify your investments.

- Expand your portfolio across equity, fixed-income, real estate, and other long-term instruments.

- Rebalance annually to reduce unnecessary risk

- Focus on steady, long-term growth rather than high-risk experimentation.n

3. Prepare for children’s education or future family needs.

- Start or strengthen education funds.

- Explore investment avenues like SIPs, child education plans, or a dedicated savings account.

- Estimate future education costs to plan early.

4. Review and reinforce insurance coverage.

- Update term insurance amounts to reflect current lifestyle and responsibilities.

- Upgrade health insurance for the family and dependents.

- Consider accidental or critical illness plans for added protection.

5. Address mortgages and long-term debt.t

- Pay extra EMIs when possible to reduce the overall interest burden.n

- Avoid taking on unnecessary new loans.

- Create a plan to close major debts before your 50s

6. Support aging parents

- Understand their financial needs, medical expenses, or long-term care requirements.

- Ensure they have adequate health coverage.

- Discuss estate plans respectfully and clearly.

The table below summarizes the essential financial goals by age for your 40s, emphasizing retirement contributions, debt reduction, and family-focused planning. These goals help you balance current obligations with future financial confidence.

| Area | Goal | Why It Matters |

| Retirement Planning | Maximize contributions | Ensures a strong, growing retirement corpus |

| Investment Growth | Diversify & rebalance | Reduces risk and supports long-term wealth |

| Family Planning | Save for education & family needs | Prevents heavy financial strain later |

| Insurance | Update & increase protection | Shields family from unexpected financial stress |

| Debt Management | Pay down major loans | Helps simplify finances before entering your 50s |

| Elder Support | Understand parents’ needs | Ensures smooth planning for family responsibilities |

4. Financial Goals in Your 50s

Your 50s are a crucial decade for financial planning. This is when retirement stops feeling distant and starts becoming a real, time-bound milestone. At this age, your financial goals by age should focus on strengthening your retirement corpus, reducing financial risks, and ensuring that major debts are under control. With only 10–15 working years left for most people, every financial decision becomes more intentional and strategic.

This decade often brings clearer priorities: securing health, simplifying finances, catching up on retirement contributions, and ensuring you’re prepared for the lifestyle you want after work. It’s also the time to think deeply about long-term care, legacy planning, and ensuring your partner or dependents are financially protected.

.jpg)

Key Priorities in Your 50s

1. Increase retirement contributions (catch-up contributions)

- Maximize retirement savings through catch-up options available after age 50

- Increase SIPs or long-term investments aligned with retirement goals.

- Reassess your target retirement age and required corpus.

2. Review investment portfolio and reduce unnecessary risk.

- Shift part of your portfolio toward stable, lower-risk assets.

- Maintain diversification while prioritizing capital preservation.n

- Evaluate whether your investments match your retirement timeline. ne

3. Eliminate or reduce remaining major debts.

- Aim to close mortgages, large loans, or high-interest EMIs.

- Avoid new long-term debt to keep retirement cash flow flexible.

- Reevaluate lifestyle spending to free up additional savings.

4. Strengthen health and life insurance.

- Upgrade health insurance coverage to match rising medical costs.

- Add critical illness coverage if not already done.

- Review life insurance to ensure dependents are protected.d

5. Build a retirement lifestyle plan.

- Estimate your retirement expenses based on lifestyle, healthcare, and inflation.

- Identify income sources: savings, investments, pensions, rental income, etc.

- Conduct a financial check-up every year to track progress.

6. Review estate and legacy planning

- Update your will and nominated details.ls

- Simplify financial documents and keep them accessible.

- Discuss plans with family to avoid future confusion.

The table below provides a clear snapshot of the financial goals by age that matter most in your 50s. With retirement approaching, the focus shifts toward maximizing savings, reducing risk, eliminating debt, and reinforcing financial protection.

| Area | Goal | Why It Matters |

| Retirement Savings | Maximize contributions & catch-up options | Helps build a strong corpus before retirement |

| Portfolio Review | Reduce risk & stabilize investments | Protects your capital as retirement approaches |

| Debt Management | Pay off major loans | Ensures lower expenses and more financial freedom |

| Insurance | Improve health & life coverage | Shields you from rising medical and financial risks |

| Retirement Planning | Define lifestyle & income sources | Helps create a realistic, sustainable retirement plan |

| Estate Planning | Update will & documentation | Simplifies future decisions for your family |

5. Financial Goals in Your 60s

Your 60s are the decade where financial planning turns into financial living. This is when your decades of saving, investing, and planning finally begin to take shape. At this stage, your financial goals by age should focus on retirement readiness, income stability, healthcare preparation, and ensuring that your financial decisions support a comfortable, stress-free lifestyle.

For many, the 60s mark the transition from earning to withdrawing, making it essential to optimize how and when you access your money. Retirement no longer feels like a distant goal; it becomes your new reality. This decade is about protecting your wealth, managing expenses wisely, and ensuring that your retirement strategy is built to last.

Key Priorities in Your 60s

1. Decide on your retirement age and transition plan.

- Choose when to retire based on finances, health, and personal goals.

- Understand the difference between early, full, and delayed retirement benefits.

- Create a withdrawal strategy that minimizes taxes and maximizes income longevity.

2. Enroll in Medicare or senior health coverage (if applicable)

- Review eligibility timelines for Medicare or senior insurance.

- Choose supplemental plans to cover additional expenses.

- Prepare for rising healthcare costs, long-term care, or home-care support.

3. Finalize your retirement income plan.

- Identify all income sources: pensions, savings, investment returns, rental income, etc.

- Shift part of your portfolio to stable income-generating assets.

- Calculate safe withdrawal rates to avoid outliving your savings.

4. Simplify your financial life.

- Reduce unnecessary accounts or credit lines.

- Streamline investments to avoid complexity.ty.

- Organize and digitize financial documents for easy access.

5. Pay off remaining debts.

- Close any existing home loans, personal loans, or credit card dues.

- Prioritize living debt-free before or soon after retirement.

- Reevaluate lifestyle spending to maintain a healthy financial balance.

6. Strengthen estate and legacy planning.g

- Update wills, nominee details, insurance beneficiaries, and power of attorney

- Discuss end-of-life and legacy wishes with family.

- Ensure finances are structured to support your spouse or dependents.

The table below highlights the critical financial goals by age for your 60s, where retirement readiness, healthcare planning, and income stability become top priorities. It helps you understand how to transition smoothly from earning to living off your savings.

| Area | Goal | Why It Matters |

| Retirement Timing | Decide retirement age & withdrawal plan | Ensures a smooth and financially stable transition |

| Healthcare | Enroll in Medicare / senior plans | Protects against rising medical costs |

| Income Strategy | Build a stable income plan | Helps your savings last throughout retirement |

| Financial Simplification | Organize and consolidate accounts | Reduces complexity and makes management easier |

| Debt | Clear remaining loans | Supports a stress-free retirement with fewer expenses |

| Estate & Legacy | Finalize documentation | Provides clarity and security for your family |

6. Preparing for Retirement

Preparing for retirement is not just about reaching a certain age; it’s about reaching a point of financial confidence. By this stage, your lifetime of planning, saving, and investment decisions comes together to determine how comfortable and secure your post-work years will be. Whether you aim for a quiet, relaxed lifestyle or an active one filled with travel, hobbies, or new ventures, your financial goals by age should now focus on creating a stable, predictable, and sustainable income plan.

Retirement preparation involves more than just building a corpus. It includes understanding how long your money needs to last, accounting for inflation, planning for medical expenses, and making smart withdrawal choices. With rising life expectancy and changing economic conditions, this stage requires clarity, discipline, and ongoing review.

Key Steps to Prepare for Retirement

1. Calculate your retirement corpus.

- Estimate monthly expenses for your desired lifestyle.

- Consider inflation and healthcare costs for the next 20–30 years.

- Use a retirement calculator to find your ideal corpus.

2. Create a retirement income strategy.

- Identify all income streams: pension, provident fund, savings, SIPs, annuities, and rental income.

- Decide your withdrawal rate (e.g., 3–4% annually)

- Aim for a mix of stable and growth-oriented investments.

3. Strengthen your healthcare and long-term care plans.

- Upgrade to comprehensive senior health insurance.

- Set aside funds or buy policies for long-term care.

- Review medical history to plan for potential treatments.

4. Reduce financial liabilities

- Clear all remaining loans or debts.

- Reevaluate discretionary spending

- Maintain only essential credit lines.

5. Align investments with retirement needs.

- Move toward safer, income-generating instruments.

- Consider annuity plans, bonds, SWPs, and low-risk funds.

- Keep a portion in equities to beat inflation, but with controlled exposure.

6. Review estate and legacy plans

- Finalize your will, beneficiaries, and power of attorney.

- Organize all financial documents in one place.

- Communicate plans to family for clarity and transparency.y

This comprehensive table brings together the most important financial goals by age across all decades, giving you a clear view of how your financial priorities evolve. It helps you track progress, identify gaps, and stay aligned with long-term financial success.

| Area | Goal | Why It Matters |

| Retirement Corpus | Calculate the exact amount needed | Helps you plan confidently and avoid shortages |

| Income Planning | Build diversified income streams | Ensures stable cash flow throughout retirement |

| Healthcare | Strengthen coverage & long-term care | Protects savings from high medical costs |

| Debt-Free Living | Clear liabilities | Reduces monthly burden and improves security |

| Investment Alignment | Shift to safer assets | Preserves capital and supports income needs |

| Estate Planning | Finalize all documents | Ensures smooth asset transfer and family clarity |

Recommended Reading

Conclusion

Planning your financial goals by age is one of the most effective ways to stay in control of your money and build long-term stability. Each decade brings new responsibilities, new opportunities, and new challenges, and aligning your financial decisions with these stages ensures you’re always moving forward with clarity and purpose. Whether you’re just starting in your 20s, building a family in your 30s, accelerating your investments in your 40s, or preparing for retirement in your 50s and 60s, every step adds up to a more secure and confident future.

By understanding what to prioritize at each life stage, reviewing your progress regularly, and making informed choices, you create a roadmap that supports your lifestyle, protects your loved ones, and leads you toward a comfortable retirement. Financial planning is not a one-time task; it’s a lifelong strategy. And the sooner you start, the stronger your financial future becomes.

FAQs on Financial Goals by Age

1. What are the most important financial goals by age?

The most important goals include building savings and good habits in your 20s, diversifying investments and securing insurance in your 30s, accelerating retirement planning in your 40s, maximizing contributions and reducing risk in your 50s, and finalizing income and healthcare plans in your 60s. These age-specific goals help you stay financially prepared through each life stage.

2. Is it too late to start planning if I’m in my 40s or 50s?

No. While starting early provides more compounding benefits, planning in your 40s or 50s is still effective. Focus on maximizing retirement contributions, reducing debt, strengthening insurance, and creating a realistic retirement plan based on your timeline and income.

3. How much should I have saved at each age?

There’s no universal number, but many financial planners suggest the following benchmarks:

○ By age 30: 1x annual salary

○ By age 40: 3–4x annual salary

○ By age 50: 6x annual salary

○ By age 60: 8–10x annual salary

These numbers vary based on lifestyle, income, location, and retirement goals.

4. Should financial goals by age change if my income fluctuates?

Yes. If your income changes due to career shifts, business cycles, or personal circumstances, adjust your savings rate, investment contributions, and debt strategy. The decade-based goals serve as a guide; you can adapt them to your financial reality.

5. What is the biggest mistake people make with age-based financial planning?

The most common mistake is delaying retirement planning and failing to invest early. Other frequent mistakes include not having enough insurance, not tracking spending, ignoring inflation, and postponing estate planning until later years.