Key Points:

- OECD revises tax deal, U.S. exempt

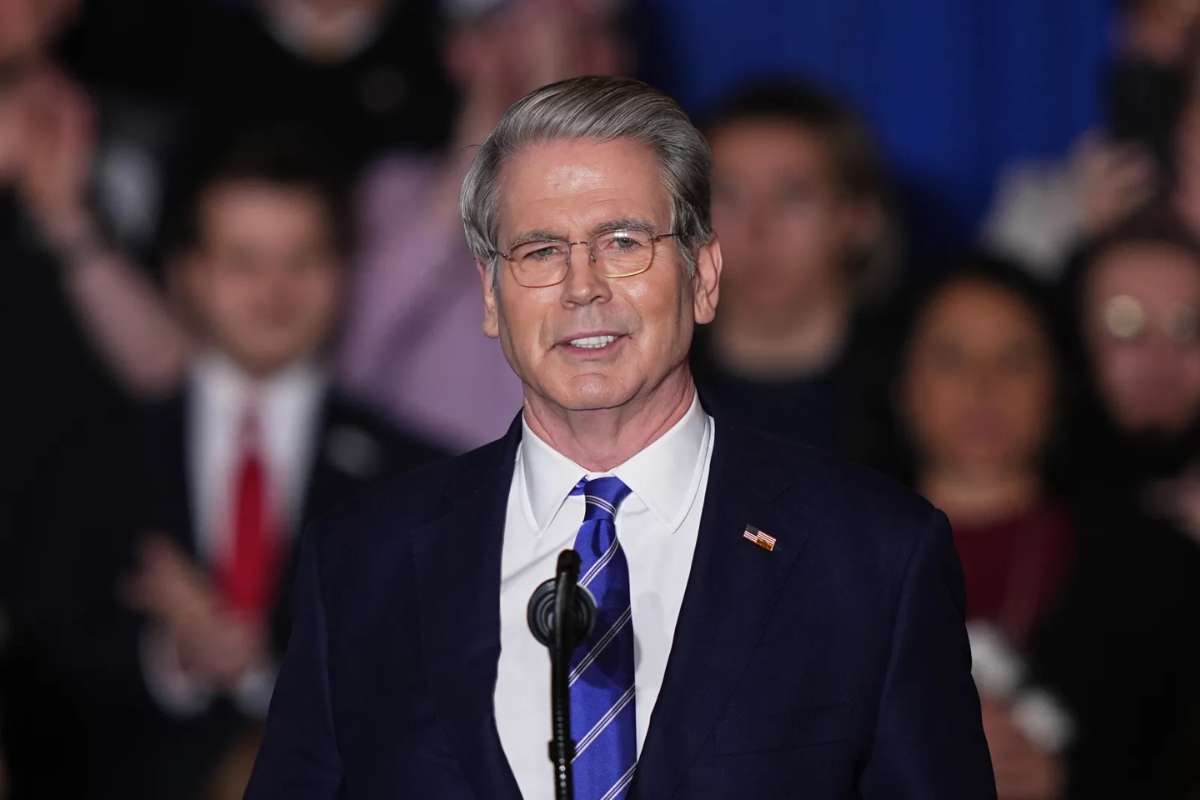

- U.S. Treasury Secretary Scott Bessent’s rules run parallel to OECD

- Critics say the exemption weakens fairness

Nearly 150 countries have agreed to revise a landmark global corporate tax agreement under the Organisation for Economic Co-operation and Development (OECD), marking a significant shift in international tax policy. The updated framework retains a 15% minimum tax rate for large multinational companies but introduces a major exemption for U.S.-based corporations, allowing them to operate outside key enforcement mechanisms of the deal.

The original agreement, finalised in 2021, aimed to curb aggressive tax avoidance by multinational firms earning more than €750 million annually. It sought to prevent companies from shifting profits to low-tax jurisdictions and was designed to bring greater fairness and consistency to global corporate taxation. However, resistance from the United States over sovereignty and competitiveness concerns led to prolonged negotiations and, ultimately, a revised structure.

Under the amended framework, U.S. companies will continue to be governed primarily by domestic minimum tax rules rather than being subject to the OECD’s “Pillar Two” system. The agreement introduces a “side-by-side” arrangement that allows U.S. tax laws and the global framework to coexist, easing tensions that had threatened to derail the entire pact.

Political Pressure and Diverging Global Views

The exemption reflects sustained political pressure from Washington following a shift in U.S. administration policy. The White House argued that the global tax rules, as originally drafted, risked undermining domestic tax authority and penalising American firms that already face relatively high effective tax rates. The administration also warned that failure to accommodate U.S. concerns could trigger retaliatory tax measures against countries enforcing the rules on American companies.

U.S. Treasury Secretary Scott Bessent described the outcome as a “historic victory” that safeguards American innovation, research, and job creation. Business groups echoed this sentiment, welcoming the revised deal as a step toward preserving competitiveness for U.S. multinationals operating in global markets.

However, the exemption has drawn criticism from tax justice advocates and some international policymakers. Critics argue that allowing the world’s largest economy to opt out of core elements of the framework weakens the credibility of the global minimum tax and risks reopening loopholes the agreement was designed to close. They warn that the carve-out could undermine efforts to create a level playing field and reduce public revenues in developing and advanced economies alike.

What the New Framework Means Going Forward?

Despite concerns, OECD officials have described the revised agreement as a pragmatic compromise that preserves international cooperation while preventing a collapse of the broader initiative. With dozens of countries already implementing elements of the original framework, the updated deal aims to provide stability and predictability for governments and businesses navigating cross-border taxation.

The agreement is expected to reduce legal uncertainty, streamline compliance, and prevent overlapping tax claims among participating nations. Still, its long-term effectiveness will depend on how consistently countries apply the revised rules and whether further exemptions or adjustments emerge.

As global economic pressures intensify and governments seek sustainable revenue sources, the revised OECD tax deal underscores the delicate balance between national sovereignty and multilateral cooperation. While the framework remains intact, the U.S. exemption, highlighted by Scott Bessent, demonstrates the influence of national interests in shaping global standards.

Visit Visionary CIOs Magazine for the latest information.