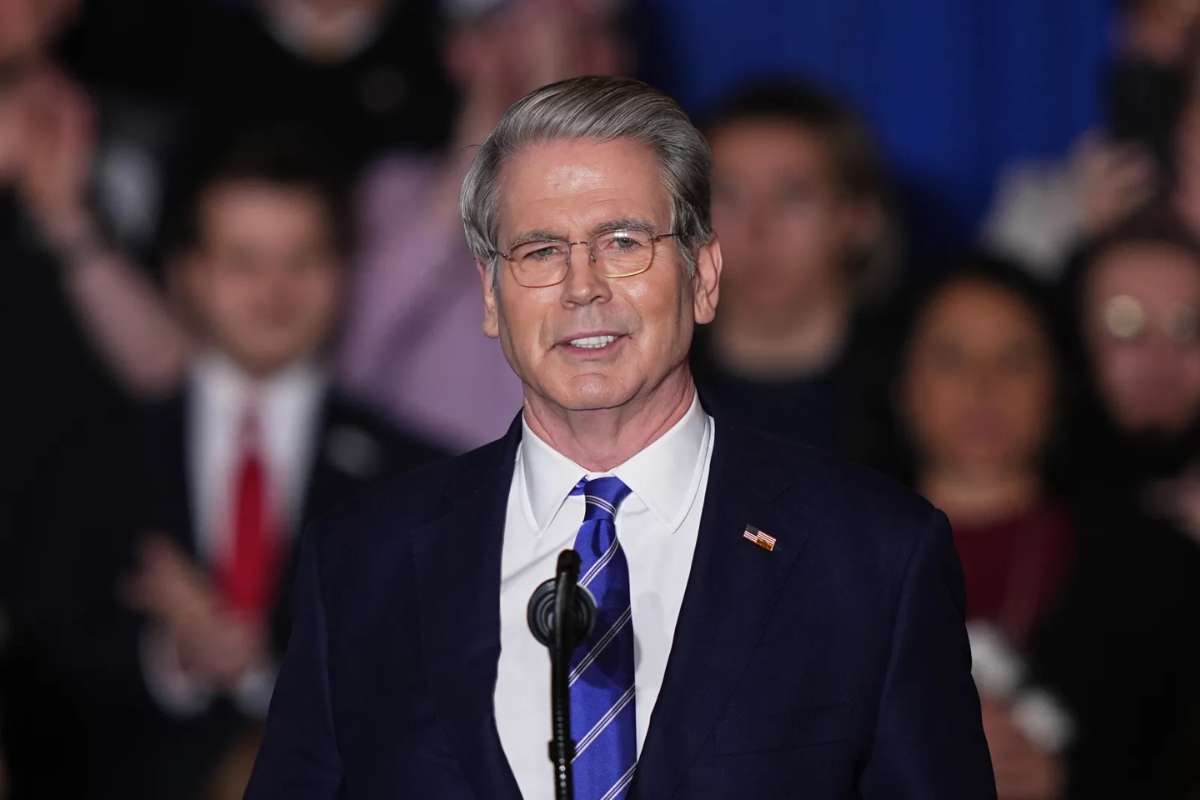

Technology billionaire and investor Peter Thiel donation $3 million to a prominent California business advocacy group actively opposing a proposed wealth tax aimed at the state’s richest residents. The donation represents one of the largest private contributions made so far against the initiative and underscores rising resistance from influential figures in Silicon Valley.

The funds were directed to the California Business Roundtable, an organization that represents major employers and has taken a leading role in challenging the proposed tax. While the contribution was not explicitly designated for a single campaign, it significantly strengthens opposition efforts at a critical stage in the initiative’s development.

Peter Thiel, a co-founder of PayPal and Palantir Technologies, has long been critical of policies he views as punitive toward entrepreneurs and investors. His Peter Thiel donation to oppose California’s billionaire tax is widely interpreted as both a financial and symbolic move, signaling concern among wealthy business leaders over California’s tax trajectory. The donation also comes amid a broader trend of high-net-worth individuals reassessing their ties to the state.

Inside the Proposed Wealth Tax and Peter Thiel Donation Impact

The ballot initiative, informally known as the Billionaire Tax, seeks to amend California’s constitution to impose a one-time wealth levy of up to 5% on individuals and trusts with net assets exceeding $1 billion. The measure would apply to a wide range of holdings, including private company stakes, financial securities, intellectual property, and luxury assets, while excluding primary residences and certain retirement accounts.

Supporters argue the tax would generate tens of billions of dollars in revenue, with the majority allocated toward healthcare services and the remainder directed to education, food assistance, and other social safety-net programs. Advocates frame the proposal as a response to widening economic inequality and ongoing budget pressures facing public services.

At present, the initiative remains in the signature-collection phase and must meet a high threshold to qualify for the 2026 statewide ballot. Organizers say momentum is building, though the proposal faces strong institutional and political headwinds even if it advances to voters.

Economic Fears, Political Pushback, and an Uncertain Path Ahead

Opponents of the measure warn that the tax could have far-reaching economic consequences. Critics argue it may discourage investment, prompt capital flight, and accelerate the relocation of wealthy individuals and companies to lower-tax states. California Governor Gavin Newsom has publicly opposed the initiative, cautioning that it could undermine the state’s economic competitiveness.

Recent years have already seen notable business leaders and technology executives shift assets or residency outside California, citing taxes, regulation, and cost pressures. Business groups contend the proposed levy would intensify those trends at a time when the state is seeking to retain innovation and job creation.

The debate has exposed deep divisions within California’s political landscape. While labor unions and progressive groups emphasize fairness and fiscal responsibility, business leaders and moderates stress economic stability and long-term growth. With powerful donors such as the notable Peter Thiel donation now entering the fray and signature collection ongoing, the billionaire tax proposal is shaping up to be one of the state’s most closely watched and contested policy battles in the run-up to 2026.