Global markets jumped as a U.S.–Japan trade deal cut auto tariffs from 27.5% to 15%, fueling gains for Japan Detroit Automakers. The agreement, announced on July 23–24, triggered a sharp uptick in investor confidence, with major U.S. automakers — General Motors (+9%), Stellantis (+12%), and Ford (+2%) — all posting notable gains. The S&P 500 rose 0.8%, the Dow Jones climbed over 500 points, and the Nasdaq hit a fresh high, reflecting optimism over potential trade normalization.

Japan’s Nikkei index jumped more than 3%, propelled by automotive stocks. The positive sentiment extended to South Korean and European carmakers like Hyundai, Kia, Volvo, and Porsche, as speculation mounted over similar tariff relief deals with the EU and South Korea. Analysts from Barclays and Morgan Stanley noted this could signal a wider U.S. pivot toward recalibrated, lower global auto tariffs, potentially standardizing a 15% rate across key partners.

U.S. Automakers Raise Red Flags Over Trade Imbalance

Despite market gains, leading American automakers voiced frustration with the agreement. The so-called “Detroit Three” — GM, Ford, and Stellantis — criticized the deal for disadvantaging U.S.-manufactured vehicles, especially those assembled in North America. Vehicles built in Mexico or Canada, under the current regime, remain subject to tariffs as high as 25%, while Japanese imports now benefit from significantly reduced rates.

Trade advocacy groups, including the American Automotive Policy Council and the United Auto Workers union, called the deal a setback for American manufacturing. GM revealed it has already incurred over $1.1 billion in tariff-related costs due to previous duties on imported components and raw materials. Industry experts warned that such discrepancies could erode pricing competitiveness for U.S. automakers in both domestic and international markets.

Analysts noted that while Japanese brands get favorable treatment, many U.S. companies are still burdened with higher duties, even when their vehicles are made within trade-friendly zones like Canada or Mexico. This “asymmetrical trade framework,” as described by Morningstar’s David Whiston, is seen as a critical disadvantage that could disrupt sales and labor stability in the American auto sector.

Trade Policy Meets Political Strategy

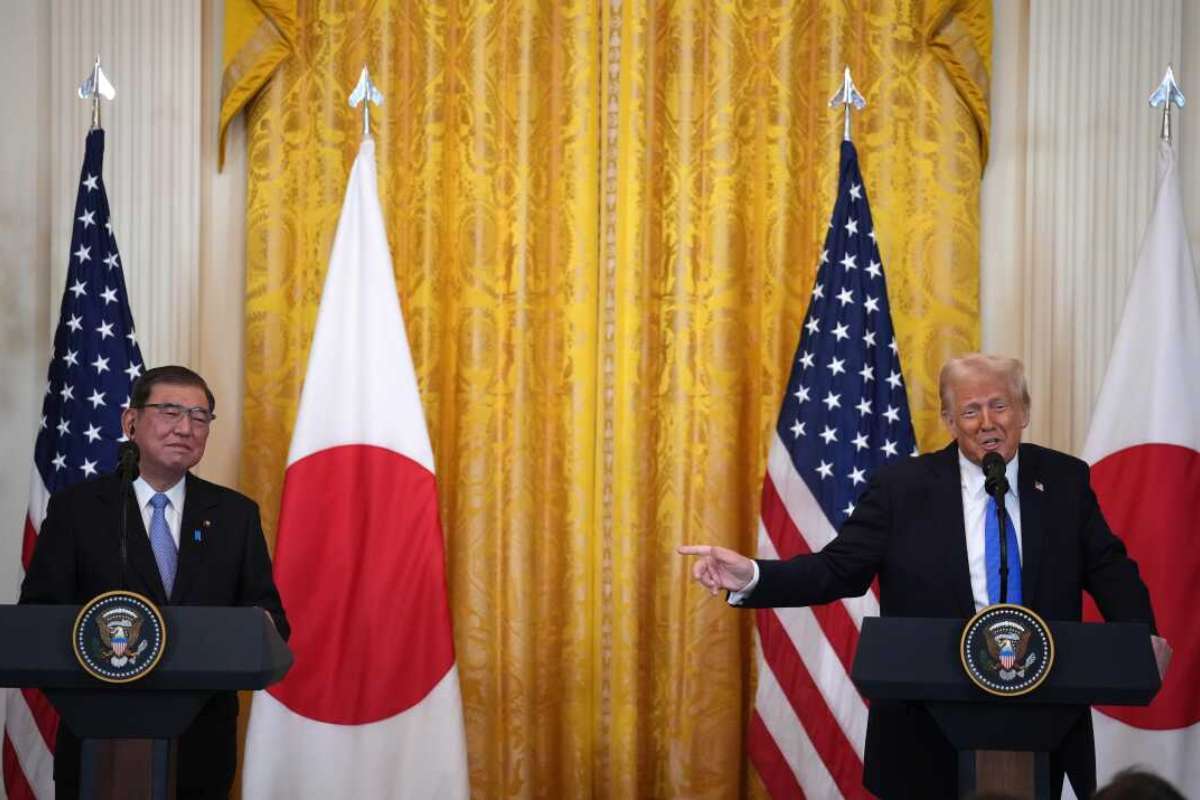

The deal is not just about cars. Alongside tariff cuts, Japan Detroit Automaker committed to a $550 billion investment package focused on U.S. sectors like semiconductors, agriculture, energy, and biotech. President Trump called it “the biggest trade win in American history,” while Japanese Prime Minister Shigeru Ishiba lauded it as “a landmark partnership.”

The strategic timing also raised eyebrows. With U.S. midterms looming, Trump appears to be cementing his trade-first narrative, promising better deals for American workers and industries. On Japan’s side, Ishiba, who recently suffered a legislative defeat, welcomed the diplomatic boost as a much-needed political win.

Meanwhile, attention now turns to other U.S. trade relationships. Officials hinted at ongoing negotiations with the EU, South Korea, Indonesia, and the Philippines, ahead of the August 1 deadline for new tariff decisions. If those talks follow the Japan Detroit Automaker model, it could lead to sweeping changes in global supply chains, trade dynamics, and manufacturing strategies.

Visit Visionary CIOs for the most recent information.