In today’s ever-evolving financial landscape, stock market investment remains one of the most potent vehicles for wealth creation and financial growth. With the right knowledge, strategy, and patience, individuals can leverage the stock market to build a secure financial future. In this comprehensive guide, we delve into the intricacies of stock market investment, exploring its benefits, risks, and essential strategies for success.

Understanding Stock Market Investment

Stock market investment involves purchasing shares of publicly traded companies with the expectation of generating returns through dividends and capital appreciation. Investors can buy and sell these shares through stock exchanges like the New York Stock Exchange (NYSE) or the Nasdaq, where prices are determined by supply and demand dynamics.

Why Invest in the Stock Market?

Stock market investment offers several compelling advantages for investors:

1. Potential for High Returns

Historically, the stock market has delivered higher returns compared to other investment avenues such as bonds or savings accounts. Over the long term, well-chosen stocks have the potential to significantly outperform inflation and generate substantial wealth.

2. Diversification

Investing in a diverse range of stocks allows investors to spread their risk across different industries and sectors. This diversification helps mitigate the impact of adverse events on any single investment, reducing overall portfolio volatility.

3. Liquidity

Stocks are highly liquid assets, meaning they can be easily bought or sold on the stock exchange. This liquidity provides investors with the flexibility to adjust their portfolios quickly in response to changing market conditions or investment goals.

4. Ownership Stake

When you invest in stocks, you become a partial owner of the underlying companies. This ownership entitles you to a share of the company’s profits through dividends and gives you a voice in corporate decisions through voting rights at shareholder meetings.

Essential Strategies for Stock Market Investment

To maximize the potential of stock market investment, investors should adopt a disciplined approach and employ proven strategies:

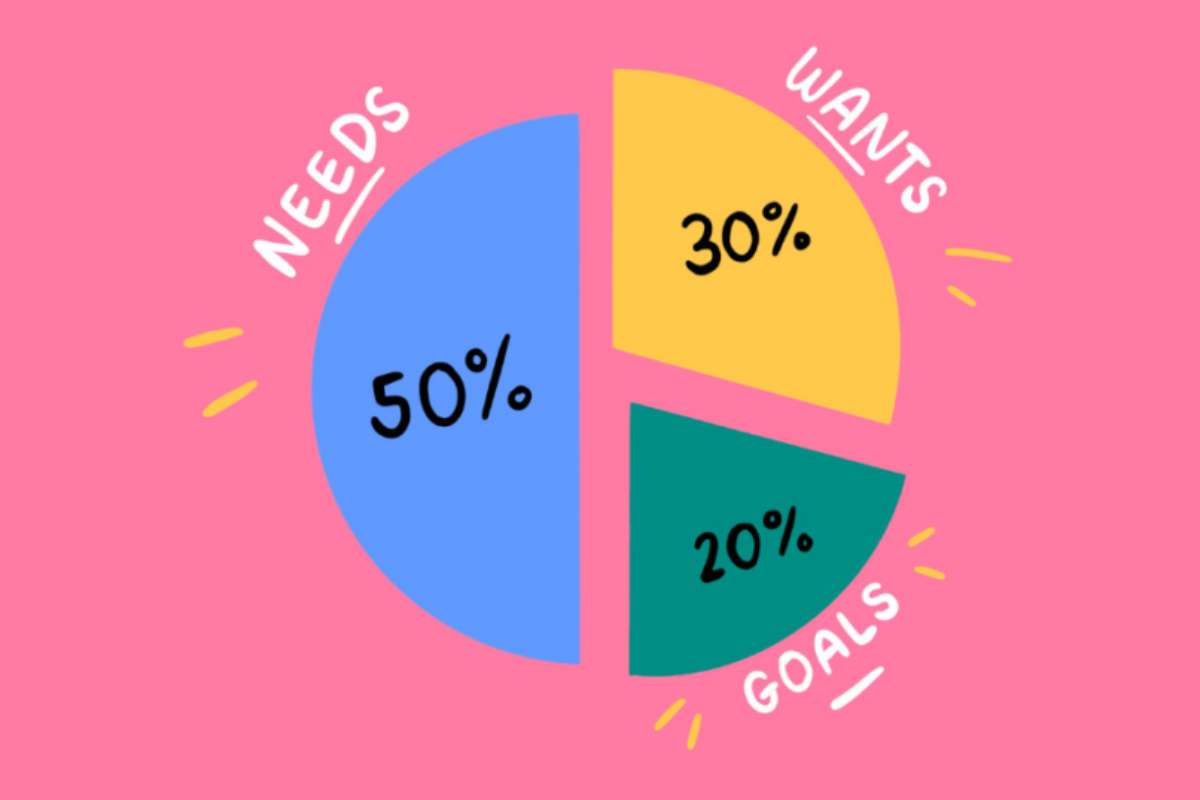

1. Diversify Your Portfolio

Avoid putting all your eggs in one basket by diversifying your investments across different sectors, industries, and asset classes. Diversification helps spread risk and reduces the impact of volatility on your overall portfolio.

2. Do Your Research

Before investing in any stock, conduct thorough research into the company’s fundamentals, including its financial health, competitive position, and growth prospects. Analyze key metrics such as earnings growth, revenue trends, and debt levels to make informed investment decisions.

3. Invest for the Long Term

While short-term market fluctuations are inevitable, focus on the long-term performance of your investments. Adopt a buy-and-hold strategy for quality companies with strong fundamentals, allowing time for your investments to grow and compound over the years.

4. Stay Informed

Keep abreast of market trends, economic indicators, and geopolitical events that could impact stock prices. Stay informed through reputable financial news sources, analyst reports, and investment forums to make timely adjustments to your portfolio when necessary.

Mitigating Risks in Stock Market Investment

While the potential rewards of stock market investment are enticing, it’s essential to be aware of the associated risks and take steps to mitigate them:

1. Market Volatility

Stock prices can fluctuate widely in response to market sentiment, economic conditions, or company-specific news. To mitigate volatility risk, maintain a diversified portfolio and focus on the long-term performance of your investments.

2. Company-Specific Risks

Individual companies may face risks such as competitive pressures, management changes, or regulatory challenges that can impact their stock prices. Conduct thorough research and due diligence before investing in any company to assess and mitigate these risks.

3. Leverage and Margin Trading

While leverage can amplify returns, it also magnifies losses in a declining market. Avoid excessive use of leverage and margin trading, as it can expose you to significant financial risk if the market moves against your positions.

4. Psychological Bias

Emotional decision-making, such as panic selling during market downturns or chasing hot stock tips, can lead to poor investment outcomes. Maintain a disciplined approach based on rational analysis and long-term objectives to avoid succumbing to psychological biases.

Conclusion

Stock market investment offers individuals the opportunity to participate in the wealth-creation potential of the global economy. By understanding the fundamentals of stock market investing, adopting proven strategies, and mitigating risks, investors can build a robust portfolio that stands the test of time. Remember to stay disciplined, stay informed, and focus on the long-term growth of your investments. With patience and perseverance, stock market investment can serve as a powerful tool for achieving your financial goals.

In summary, stock market investment is a dynamic and rewarding endeavor that requires careful planning, diligent research, and a long-term perspective. By following the strategies outlined in this guide and staying informed about market trends, investors can unlock the full potential of stock market investment and build a brighter financial future.