How easy would our lives be if we could skip paying monthly taxes? It is illegal to avoid taxes completely. Our community’s functioning relies on various factors, and public works require funding from somewhere. Completely avoiding them? That’s illegal. But finding ways to pay less? That’s a different story.

How can you pay fewer taxes? It’s simple: just get rich. But you mustn’t take a shortcut like Jordan Belfort. You don’t want to end up in handcuffs. Instead, imagine sitting in a lavish penthouse while sipping one of the expensive whiskeys and having a conversation about the stock market, the kind Patrick Bateman would describe. Here, the topic is not just about making money. The game is all about keeping it. You don’t have to play any tricks like hiding wealth to pay fewer taxes. The whole point is to be smart at it and structure it in the right way.

Taxes are not paid yearly with the help of an accountant, it’s a year-round strategy. The affluent don’t just stash cash in the bank, they invest in assets, real estate, fine art, stocks, and even sports teams. So, what are these tax strategies for the wealthy, and how do they work? Let’s find out!

Why Tax Strategies For The Wealthy?

The U.S. tax system is progressive, meaning that the more you earn, the higher your tax rate. While most people see a significant portion of their income go to taxes, the wealthy have access to financial tools, legal loopholes, and investment structures. This results in the reduction of their tax burden. It’s not about evading taxes, it’s about making the system work in their favor.

From using trusts and charitable foundations to making the most of capital gains tax laws, tax strategies for the wealthy are designed to ensure they pay only what’s legally required. Nothing more. These strategies require careful planning, but for those who understand them, the benefits are substantial.

Here are top 6 effective tax strategies for the wealthy:

1. Try Investing In Municipal Bonds

Municipal bonds offer a unique advantage, making them one of the effective tax strategies for the wealthy. When you buy municipal bonds, the interest earned is often exempt from federal and sometimes state taxes. For the wealthy, investing in municipal bonds provides a steady income stream that’s largely tax-free, making it an attractive part of a well-rounded portfolio that minimizes taxes.

2. The Buy, Borrow, Die Strategy

One of the most effective yet lesser-known tax strategies for the wealthy is something financial insiders call the Buy, Borrow, Die approach. It sounds a little dramatic, but the concept is surprisingly straightforward and perfectly legal.

Here is the detailed briefing:

✦ Buy valuable assets:

Real Estate, fine art, or stocks come under this segment. These are not just purchases for fun; they’re long-term investments. Over time, these assets usually increase in value. As long as they don’t sell those investments, they don’t have to pay any taxes on the profits. That’s because the IRS only taxes you when you sell and actually make a profit, also known as a capital gain. So, by just holding onto these growing assets, the rich can watch their wealth balloon without paying a cent in capital gains taxes.

✦ Borrowing against those assets:

Instead of selling stock or real estate to pay for their luxury lifestyles, like buying homes, yachts, or even funding business ventures, they simply take out loans, using those assets as collateral. Why? Because loans aren’t considered income, they’re not taxable. It’s like taking out a mortgage on a mansion or a credit line using your stock portfolio as security. The money comes in tax-free, and since interest rates are often very low for the wealthy, the cost of borrowing is small compared to the tax bill they’d face if they sold the assets outright.

✦ Die and pass it all on:

When the original owner passes away, those assets go to their heirs, but with a major tax benefit. The value of the asset is stepped up to whatever it’s worth at the time of death. That means all the gains that built up over decades? Erased for tax purposes. So if a stock was bought at $100 and is worth $1,000 when inherited, the IRS pretends the heir got it at $1,000. If the heir sells it right away, there’s no capital gains tax at all.

3. Utilizing Tax-Advantaged Accounts

Tax-advantaged accounts are another cornerstone in the arsenal of tax strategies for the wealthy. Maximizing contributions to accounts like Roth IRAs, Health Savings Accounts (HSAs), and high-income earners can shield significant portions of their income from taxes. For instance, contributing to an HSA not only provides a tax deduction but also allows the money to grow tax-free, provided it’s used for qualified medical expenses. This dual benefit of immediate deductions and tax-free growth makes HSAs particularly attractive.

4. Life Insurance as a Tax Shield

Permanent life insurance policies, such as whole life or universal life insurance, offer unique tax benefits that the wealthy can use for their financial planning. These policies allow funds to grow tax-free within the policy, and beneficiaries receive the death benefit tax-free. Moreover, the wealthy can borrow against the policy’s cash value tax-free, creating a source of liquidity without triggering taxable events. This is often referred to as the private banking strategy, where high-net-worth individuals use life insurance as a tax-efficient savings and borrowing tool.

5. Income Shifting and Family Limited Partnerships

Income shifting involves transferring income-generating assets to family members in lower tax brackets. By doing so, the overall tax burden on the family’s income is reduced. Family Limited Partnerships (FLPs) are often used in this context, allowing wealth to be transferred to heirs at discounted values while retaining control over the assets. This strategy not only minimizes taxes but also facilitates estate planning and wealth preservation across generations.

6. Offshore Accounts and Tax Havens

While often controversial, the use of offshore accounts and tax havens remains one of the prevalent tax strategies for the wealthy. By establishing accounts or entities in jurisdictions with favorable tax laws, individuals can defer or reduce taxes on income and gains. It’s crucial, however, to navigate these waters carefully, as international tax laws are complex and continually evolving.

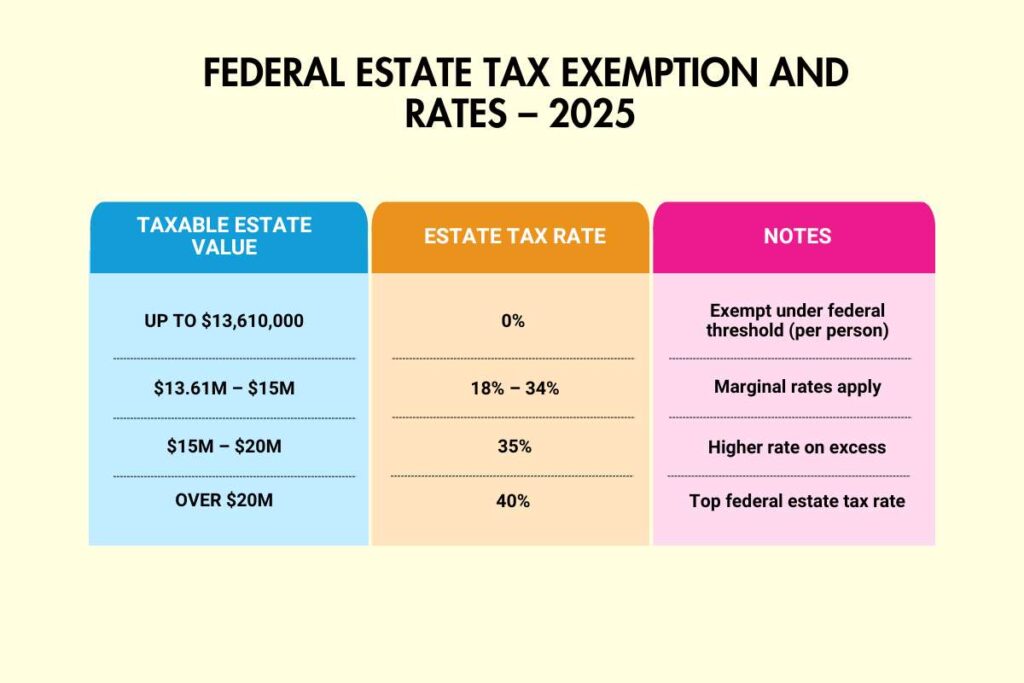

Federal Estate Tax Exemption and Rates – 2025

| Taxable Estate Value | Estate Tax Rate | Notes |

| Up to $13,610,000 | 0% | Exempt under federal threshold (per person) |

| $13.61M – $15M | 18% – 34% | Marginal rates apply |

| $15M – $20M | 35% | Higher rate on excess |

| Over $20M | 40% | Top federal estate tax rate |

Conclusion

When building wealth, making money is only half the battle; keeping it is where the real strategy begins. For high-net-worth individuals, tax planning isn’t a once-a-year activity; it’s a year-round, well-structured game. From municipal bonds and tax-advantaged accounts to the surprisingly simple Buy, Borrow, Die approach, tax strategies for the wealthy revolve around playing smart and staying within legal boundaries.

These strategies aren’t about avoiding responsibility, they’re about using the system the way it was designed. And while they might not be accessible to everyone, they offer a fascinating look at how wealth is preserved, protected, and passed on. If you’re on the path to financial growth, understanding these moves could one day help you play the game just as wisely.