Shareholders Demand Accountability

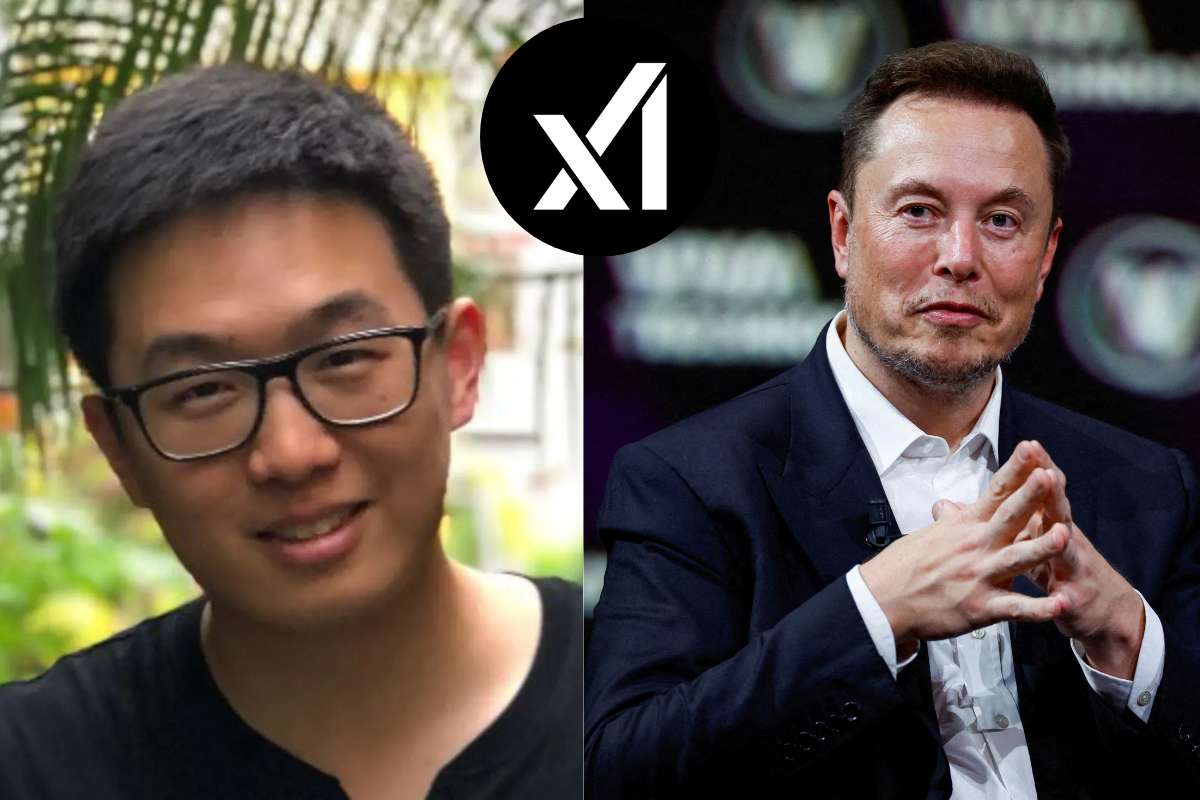

Tesla investors are expressing frustration as the company’s Tesla’s stock decline continues to, using CEO Elon Musk’s own words against him. In a move reminiscent of a controversial directive to federal employees, shareholders are now asking Musk to list five things he has done for them. The stock took another hit on Thursday, marking its sixth consecutive trading session in the red.

The situation draws parallels to an incident involving a government official who recently faced backlash for requiring civil servants to justify their pay by listing their weekly accomplishments. Now, Tesla investors are turning the tables on Musk, demanding answers via his social media platform, X. Celebrity photographer Jerry Avenaim took to the site on Wednesday, posting, “Please share five things you did for Tesla shareholders this week. Or are you working remotely? Asking for all of us,” alongside a graph depicting the stock’s poor performance.

Despite investor concerns, Tesla has yet to respond to media inquiries regarding the ongoing Tesla’s stock decline.

Backlash Over Musk’s Directive to Federal Employees

The controversy surrounding Musk escalated when he issued a directive last Saturday demanding that all federal employees provide an account of their weekly accomplishments. The message ended with a stern warning: failure to respond would be considered a resignation. While Musk had the authority to enforce such policies at Twitter, a company he owns, his attempt to apply a similar approach to government employees was met with resistance.

Several high-ranking officials advised federal workers to ignore the directive, leading Musk to soften his stance. Initially, he suggested that even a minimal effort would suffice, stating, “The passing grade is literally just ‘Can you send an email with words that make any sense at all?’” Later, he further downplayed the requirement, clarifying that it was merely a way to ensure employees were responsive.

In an effort to mend relationships, an administration official publicly acknowledged Musk’s cost-cutting efforts, crediting him with working to reduce government spending. However, this did little to quell concerns about his increasing influence and controversial actions.

Tesla Faces Market Challenges Despite Model Y Refresh

Tesla shareholders find themselves in a difficult position. While the company’s stock remains 14% higher than it was on the day of the last election, recent developments suggest growing challenges. Reports indicate that Tesla’s automotive business is under significant pressure, raising concerns about the company’s financial future.

Elon Musk’s recent behavior has also drawn criticism, from personal disputes with former partners to high-profile disagreements with public figures. These distractions have contributed to growing investor unease, leading to speculation that Tesla’s first-quarter performance may fall short of expectations.

Despite these challenges, Tesla’s stock decline recently marked a milestone with the launch of a refreshed Model Y in China. The vehicle, which accounts for the majority of Tesla’s global sales, made its debut on the company’s official Weibo account. While this development offers some hope for shareholders, it remains to be seen whether the refreshed model can help reverse Tesla’s stock decline and restore investor confidence.