Managing credit cards effectively is crucial for maintaining financial stability and avoiding debt. While credit cards offer the convenience of cashless transactions and rewards, they also pose significant risks if not handled carefully. By following sound credit card management tips, you can optimize the benefits while minimizing potential downsides. In this article, we’ll explore five key strategies that will help you master your credit card use and stay on top of your financial game.

Here Are The Top 5 Credit Card Management Tips For Financial Health:

1. Keep Your Credit Utilization Low

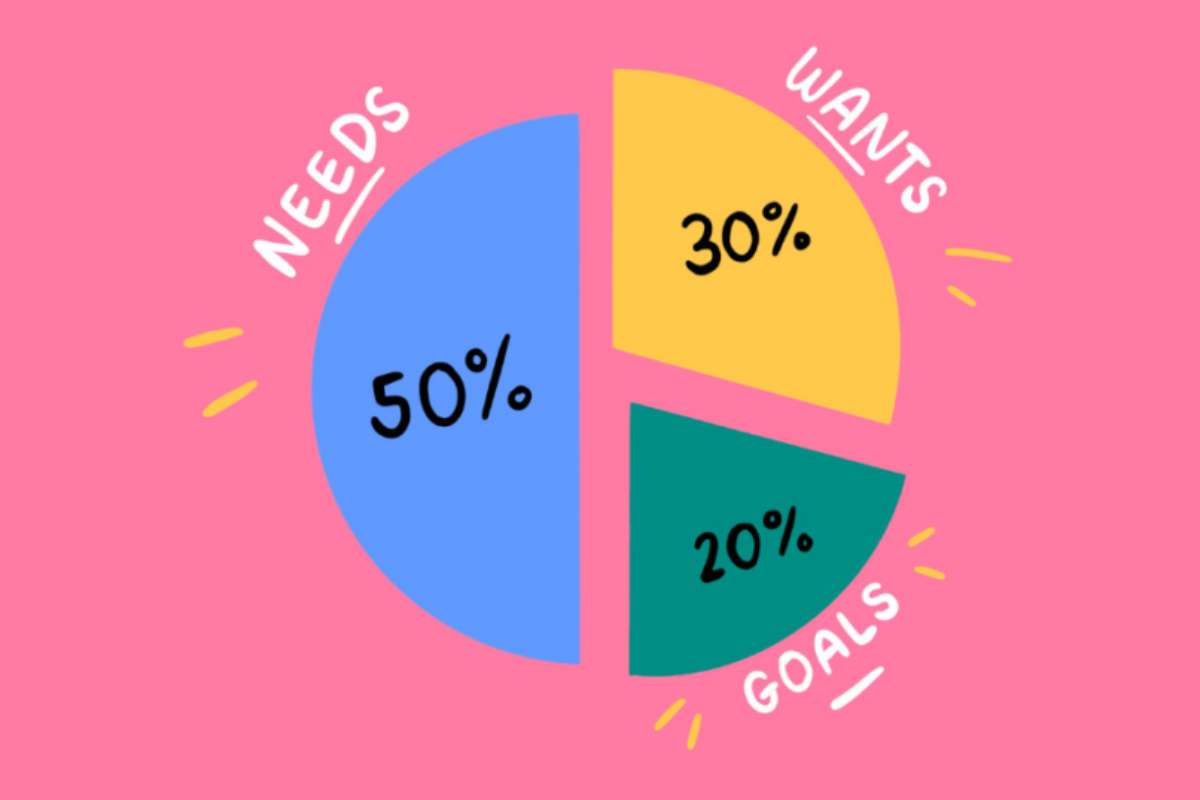

One of the most important credit card management tips is to keep your credit utilization ratio low. Credit utilization refers to the percentage of your credit limit that you’re using at any given time. For example, if your credit card limit is $10,000 and you’ve spent $3,000, your utilization ratio is 30%.

A low utilization ratio is critical for maintaining a good credit score. Ideally, you should aim to keep your credit utilization below 30%, but lower is always better. This demonstrates to lenders that you’re responsible with credit and aren’t overly reliant on borrowing.

How to Keep Credit Utilization Low?:

- Pay off your balance in full each month or as much as you can afford.

- Request a higher credit limit if you’re consistently using more than 30% of your available credit.

- Spread your purchases across multiple cards to avoid maxing out one card.

2. Pay Your Bills on Time

Paying your bills on time is a cornerstone of good credit management. Late payments not only result in hefty late fees but also harm your credit score. A lower credit score can make it harder for you to get approved for loans or other credit products in the future, and you may end up paying higher interest rates on existing debt.

Many credit card companies report payment activity to credit bureaus, and even one late payment can stay on your credit report for up to seven years. Therefore, making timely payments is one of the most fundamental credit card management tips to follow.

Tips for Ensuring Timely Payments:

- Set up automatic payments or reminders to avoid missing due dates.

- If you’re struggling to make full payments, pay at least the minimum amount due to avoid penalties.

- Check your billing statement regularly for any inaccuracies or unexpected charges.

3. Avoid Carrying a Balance Whenever Possible

Carrying a balance on your credit card can lead to significant interest charges over time. Credit cards typically have high interest rates compared to other types of loans, and carrying a balance from month to month means you’ll be paying more than the original amount of your purchases. This is why one of the most important credit card management tips is to avoid carrying a balance whenever possible.

If you find yourself unable to pay off the full balance, try to pay more than the minimum amount. By doing so, you can reduce the interest you accrue and pay off your debt faster.

Strategies to Avoid Carrying a Balance:

- Stick to a budget and only charge what you can afford to pay off in full each month.

- Pay off high-interest cards first if you have multiple credit cards with balances.

- Consider transferring balances to a card with a lower interest rate if you’re struggling to manage debt.

4. Monitor Your Credit Card Statements Regularly

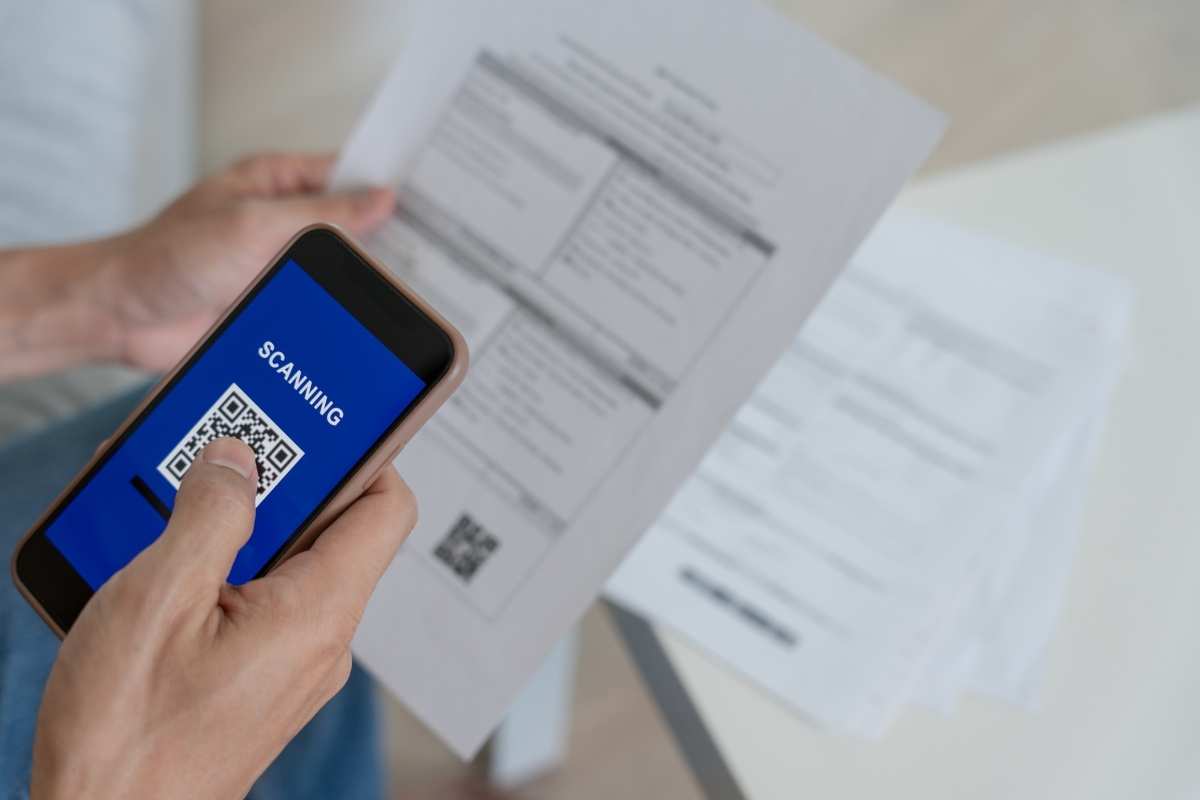

Monitoring your credit card statements regularly can help you detect fraudulent activities and track your spending. Many people overlook small charges or assume their statements are accurate without reviewing them, which can lead to costly mistakes. This is why another critical credit card management tip is to stay vigilant by checking your statements every month.

Reviewing your credit card statement also allows you to identify spending patterns and make adjustments to stay within your budget. By keeping an eye on your transactions, you’ll be able to catch any unauthorized charges and report them to your credit card issuer immediately.

How to Monitor Your Statements Effectively?:

- Sign up for email or text alerts from your credit card issuer to receive real-time notifications of charges.

- Review both the paper and online versions of your statements to ensure accuracy.

- Keep track of your receipts and compare them with your monthly statement to spot any discrepancies.

5. Understand Your Rewards Program

Credit cards often come with rewards programs that allow you to earn points, miles, or cash back for your purchases. While these rewards can be beneficial, it’s important to understand the terms and conditions of your card’s rewards program to maximize your benefits. This is one of the most overlooked but useful credit card management tips.

Different credit cards offer different rewards, and some may be more suited to your spending habits than others. For example, a card that offers cash back on groceries might not be as useful to someone who spends more on travel. By understanding how your rewards program works, you can make sure you’re getting the most value from your credit card.

How to Maximize Your Rewards:

- Choose a credit card that aligns with your spending patterns (e.g., cash back, travel rewards).

- Keep track of reward expiration dates and redemption rules to avoid losing points or miles.

- Avoid overspending just to earn rewards, as interest charges on unpaid balances can negate the value of your rewards.

Conclusion

Credit cards can be powerful financial tools when used responsibly, but they can also lead to significant debt if mismanaged. By following these credit card management tips, you can enjoy the benefits of credit cards without falling into common financial traps. Remember to keep your credit utilization low, pay your bills on time, avoid carrying a balance, monitor your statements, and understand your rewards program. These strategies will help you stay on top of your credit card use and maintain a healthy financial outlook.

Mastering these credit card management tips is a key part of maintaining good credit and ensuring long-term financial success. Whether you’re new to credit cards or looking to improve your current habits, implementing these practices will provide a solid foundation for managing your credit effectively.