Imagine two giant money companies zooming across the world, helping people buy things safely, whether it’s candy at a corner shop or a toy from the internet. That’s Visa vs Mastercard! These two are like friendly racing cars in the big world of money, always trying to be quicker, smarter, and more helpful. From shopping online to tapping a card at your favorite store, they’re everywhere! But even though they seem similar, they have a few unique tricks up their sleeves.

Visa and Mastercard have been competing for years, each one trying to lead the track when it comes to security, speed, and where you can use them. So, who’s really ahead in this exciting race? Let’s take a closer look at how these two money champions battle it out in different ways!

If They’re Not the Bank, Then What Are They?

Visa and Mastercard might look like the names on your credit or debit card, but guess what? They’re not banks. They don’t lend you money or hold your savings. Instead, they are payment networks, which means they help move your money safely between your bank and the place you’re buying from. These are the invisible messengers that ensure your card works when you tap it at a store, shop online, or book a vacation. Even though they don’t give out the cards themselves, Visa and Mastercard offer helpful extras to keep you safe and happy.

Visa-

Visa processed approximately 234 billion transactions in its 2024 fiscal year, supporting 4.6 billion card credentials globally.

Mastercard-

Mastercard processed 159.4 billion switched transactions in 2024, circulating across more than 220 countries.

Thanks to these two cards, the payment system is getting smoother because they enable fast, secure, and reliable transactions across the globe. Their advanced technology and widespread acceptance ensure your payments go through almost instantly, whether in-store or online.

For example,

- Visa may give you travel protection like trip cancellation or lost luggage insurance, help with emergency card replacement if your card is lost or stolen, or even offer roadside assistance such as towing, jump-starts, or flat tire help if your car breaks down.

- On the other hand, Mastercard might include price protection (they’ll pay the difference if something you bought gets cheaper later), identity theft protection (to help if someone tries to use your card without permission), and even extended warranties on things you buy.

So while your bank gives you the card, Visa vs Mastercard make sure it works almost everywhere and add useful perks too.

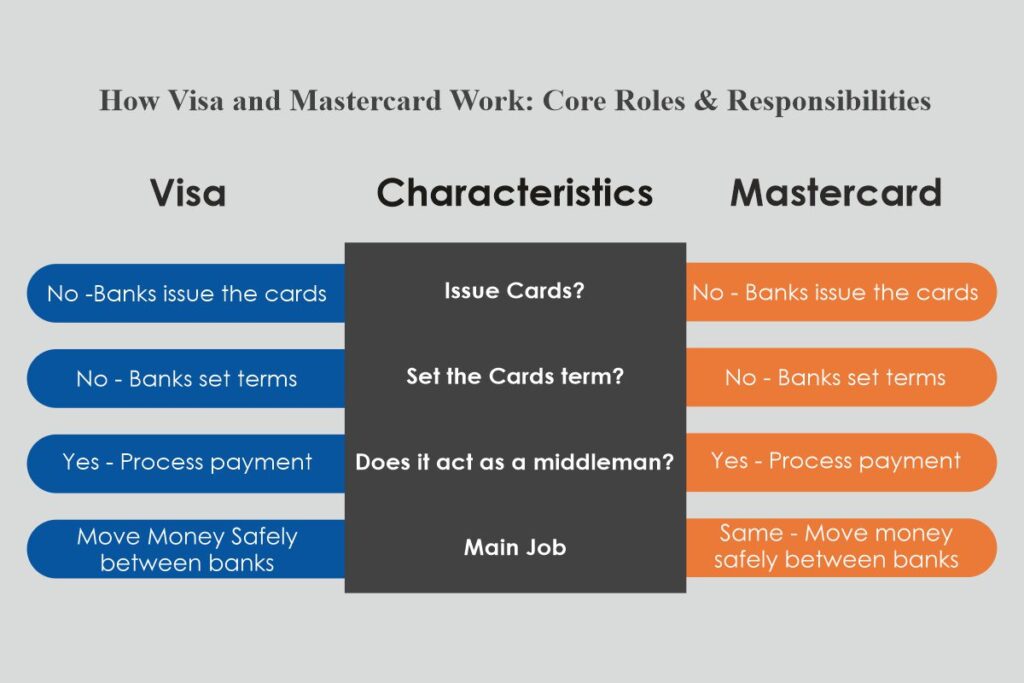

How Visa and Mastercard Work: Core Roles & Responsibilities

| Characteristics | Visa | Mastercard |

| Issue Cards? | No -Banks issue the cards | No – Banks issue the cards |

| Set the Cards term? | No – Banks set terms | No – Banks set terms |

| Does it act as a middleman? | Yes – Process payment | Yes – Process payment |

| Main Job | Move Money Safely between banks | Same – Move money safely between banks |

Features

Visa and Mastercard are two of the world’s leading payment networks, and they offer many similar features designed to make spending easy, secure, and rewarding. Both provide worldwide acceptance, allowing cardholders to use their cards at millions of merchants in over 200 countries.

1. Global Acceptance & Reach:

- Visa: Accepted in 200+ countries with over 130 million merchant locations—a powerhouse for global payments.

- Mastercard: Slightly broader presence in 210 countries, with acceptance at over 100 million merchants worldwide.

2. Card Tiers & Perks:

- Visa tiers: Traditional, Signature, Infinite, each unlocks more perks, from basic fraud protection to airport lounge access and luxury hotel benefits.

- Mastercard tiers: Standard/Base, World, World Elite—rising tiers offer concierge services, travel perks, and exclusive experiences via “Priceless.”

3. Security & Fraud Protection:

- Visa: Offers Visa Secure (3‑D Secure), tokenization, real‑time monitoring, and zero-liability policy.

- Mastercard: Provides SecureCode, Identity Check, Safety Score, AI fraud systems, and ID‑theft protection.

4. Travel & International Features:

- Visa: Strong acceptance globally; contactless Visa payWave; some cards offer Global Entry credits, rental-car coverage, lounge access.

- Mastercard: Contactless PayPass; some cards offer lower FX rates, better acceptance in certain regions, and strong partnerships in Europe and the Caribbean.

5. Rewards & Experience Perks:

- Visa: Offers Signature Luxury Hotel Collection, concierge help, travel protection, and exclusive event access.

- Mastercard: Runs the Priceless Experiences® program (sports, concerts, dining), plus travel perks, airport concierge, and partner discounts.

6. Innovation & Tech:

- Visa: Leader in tokenization, mobile wallet integration, and recent innovations like single‑card multi‑account physical cards and biometrics.

- Mastercard: Rolling out biometric-enabled metal cards (World Elite tier) globally, supports crypto payments, B2B services, and digital wallets.

Visa vs Mastercard: A Quick Comparison of Features, Usage & Market Impact

Explore how Visa and Mastercard stack up against each other in terms of usage, benefits, charges, and global reach. This side-by-side comparison highlights their unique strengths and helps you understand which card suits your needs best.

| Category | Visa | Mastercard |

| Founding Year | 1966 | 1979 |

| Usage | Best for online transactions | Best for withdrawal |

| Utilization | 4.6 billion people use Visa cards | 2.2 billion people use Mastercard |

| Revenue Growth | $9.6 billion, an increase of 9% over the year | $7.3 billion, increased by 14% over the year |

| Issued by the Bank | Private or world-class bank | National bank |

| Offers and Perks | A lot of offers | Fewer offers than Visa |

| Charges | Higher charges | Fewer charges than a visa |

| Transactions | Support both – International and National | Support both – International and National |

| Market Cap | $701.03 Billion | $524.22 less than Visa |

Similarities: Mastercard vs Visa

Visa and Mastercard are like two giant highways that banks use to move money safely and quickly, but banks are the car rental companies deciding what kind of car (card) you drive, how much it costs, and what perks come with it.

Visa vs Mastercard: Strengths Across Key Areas of Service & Innovation

| Area | Visa Strength | Mastercard Strength |

| Acceptance | Massive merchant network | Slightly broader reach in niche markets |

| Perks | Luxury travel & concierge | Lifestyle experiences & events |

| Security | Tokenization & real-time defense | Biometric, AI fraud tools, identity alerts |

| Travel | Global reach & car rental benefits | FX savings & regional dominance |

| Tech & Innovation | Digital wallets, mobile ID | Biometric metal cards, crypto readiness |

Nearly Universal Acceptance –Visa vs Mastercard

Visa-

- Accepted Worldwide: Visa cards are accepted in over 200 countries and territories, meaning you can use them almost anywhere you travel.

- Millions of Merchants: Whether you’re shopping online, in a small store, or in a supermarket, Visa is widely accepted by millions of merchants globally.

- Trusted by Businesses: Because of its reliability and global reach, Visa is a preferred choice for international and local businesses.

Mastercard-

- Global Acceptance: Like Visa, Mastercard is also accepted in over 210 countries and territories.

- Millions of Locations: You can use your Mastercard at millions of shops, restaurants, hotels, and websites around the world.

- Great for Travelers: Whether you’re paying in your hometown or overseas, Mastercard works almost everywhere Visa does.

Type of Business: Payment Networks, Not Card Issuers

Since they are not banks, Visa vs Mastercard. They don’t give you a credit or debit card directly. Instead, they work behind the scenes as payment networks, helping to move your money safely when you pay for something.

Visa: How It Works-

- Not a Card Issuer: Visa doesn’t give cards to people. Your bank or credit union (like Chase, Wells Fargo, etc.) issues a Visa-branded card.

- Payment Network: Visa acts as the middleman between your bank and the store’s bank when you make a purchase.

- Secure Transactions: Visa makes sure the money is authorized, processed, and sent safely from your bank to the merchant.

- No Credit Terms: Visa doesn’t decide your credit limit, interest rate, or fees—your bank does.

Mastercard – How It Works

- Also, Not a Card Issuer: Mastercard does not issue cards directly. Instead, your bank or lender provides the card and adds the Mastercard logo.

- Global Payment Network: Mastercard helps process payments across the world, moving money between banks during transactions.

- Supports Banks: Mastercard provides tools and technology to help banks offer secure, fast, and efficient card services.

- No Lending Role: Like Visa, Mastercard doesn’t lend money—it’s your bank that sets the borrowing terms.

Choosing between Visa and Mastercard? We hope this article helped you

Visa and Mastercard are like two superheroes of the payment world; both powerful, fast, and everywhere. They share many similarities: both are not banks but global payment networks that help move your money safely when you pay. They don’t issue cards directly but partner with banks, and they’re accepted in over 200 countries, making them trusted worldwide.

But their rivalry heats up when we look at their differences. Visa offers wider global reach and premium travel perks but may come with higher fees. Mastercard usually costs less and gives extra benefits like price protection and lifestyle rewards.

In this close race, there’s no clear winner; it depends on what you need. But one thing is sure: whichever card you choose, you’ll benefit.